Generally, efficiency in operating life insurance refers to the capacity and reliability of the insurer. This reflects an organization’s ability to balance customer satisfaction, cost control, risk management, and regulatory compliance.

Operational efficiency in a competitive market is not only the speed of the process, but also the continuous establishment of values through disciplined implementation, technology-friendliness, and strategic coordination. When all the departments work in an integrated manner with risk awareness and coordination, then all the stakeholders in the insurance sector can feel transparency and accuracy. In this article, an attempt has been made to clarify the current operating status of the insurer, the role of the department that should or should be, the risks involved in it and how these risks can be managed in the Nepali context.

Product Portfolio

A balanced product portfolio is the backbone of long-term sustainability of the life insurance business. Most of the insurance products offer savings and protection, while some offer protection. Therefore, it is important to strike the right balance between term insurance, whole life, endowment, money-back, pension and unit-linked plans. A well-analyzed combination of these products helps insurers diversify risk, ensure stable cash flow and balance long-term liabilities in line with the company’s investment strategy.

Regular actuarial reviews and profit evaluations are useful for modifying the portfolio based on market and economic conditions. If the portfolio is imbalanced, it can lead to higher risk of problems such as asset-liability matching. Therefore, continuous monitoring, diversification and stress testing are indispensable to maintain the stability of life insurers. The company should have a separate product development department that designs and develops innovative and customer-centric insurance products. This department works closely with actuaries and experts to ensure pricing and profitability. It complies with regulatory provisions. Innovation in product design further ensures competitiveness and relevance to customers.

Markets, Sales & Distribution Department

The market, sales and distribution department of the insurance company ensures the business growth of life insurance products through various channels such as branches, agents, direct sales and digital platforms. It develops a strategy for market expansion. Increases access to rural and urban areas. Monitors sales performance. It conducts publicity and incentive programs to motivate policy sellers. Maintains customer trust through mis-selling, CRM-based monitoring and performance appraisal.

An agent is a major source of premium for a company. The company’s focus is on agent selection, licensing, training, and agent productivity. This ensures regulatory compliance and timely commission payment. It also corrects errors such as preventing mis-selling, forging documents and storing false data. Transparency, continuous training, and digital monitoring systems boost a company’s reputation and productivity.

Underwriting Department

Underwriting is an important department of the insurance company. The underwriting department evaluates the insurance application and analyzes the applicant’s occupation, health status, financial status, which determines the risk profile. Ethical risks and adverse choices in underwriting can have a negative impact on its profitability.

{{TAG_OPEN_strong_127}Department of Accounting, Finance and Investment

The accounting, finance and investment departments are the main organs of keeping the financial statements of companies accurate and transparent. It does all the work related to accounting, budgeting, income, expenditure and investment. It looks at whether all regulatory requirements have been met.

It helps in making strategic decisions under NFRS-17 through accurate financial reporting, risk-based capital requirements and liquidity and profit analysis. It monitors and strategizes on challenges such as liquidity crises, financial frauds and regulatory risks. These challenges are managed through internal controls, clear separation of responsibilities, regular reconciliation, and timely audits.

The index of Nepal’s insurance market is focused on which company has the highest premium collection or how much life fund is there.TAG_OPEN_strong_126 In such a situation, the underwriting department is forced to focus on collecting more premiums than the valuation. Premium collection means that the insurance company has incurred the liability {

}

Another major function of a life insurer is investment, in which the amount should be invested according to the policy agreement, nature and need.

Reinsurance

Reinsurance provides a risk sharing to protect the company from large claims or catastrophic damages. This department assists in managing treaty agreements, individual proposals, and claims and post-claim receipts. The main risk is claimed by the reinsurer. It transfers risk. Collaborate with credible reinsurers, maintain transparent records and collaborate regularly, ensuring the stability of the company and financial security. In addition, reinsurance helps to obtain technical assistance and increase efficiency in capital management.

Information Technology

The Department of Information Technology (IT) conducts the digital journey of insurers÷companies. It operates its core insurance system, online payment platform, and customer portal in a secure and smooth manner. It focuses on strong encryption, regular backups and disaster recovery to address challenges such as cyberattacks, system failures and data leaks. Reliable information technology system makes the company fast, accurate and customer-friendly.

HR & Administration

The Department of Human Resources and Administration is responsible for recruitment, evaluation, welfare and administrative work. Its purpose is to keep employees motivated and satisfied. So that they can do a great job. The department works impartially, dealing with employee migration, workplace complaints, or procurement issues.

Claims Department

The claims department is the center of fulfilling the promises of the insurer. The maturity or death claim should be paid fairly and promptly. It carefully reviews all the necessary documents and completes the claim within the time limit. Nowadays, smart tools (e.g., AI for fraud detection) can be used to prevent fake claims or delays, which maintains transparency and customer trust.

Risk Management, Actuarial & Research

This department plays an important role in keeping the company financially strong and profitable. It performs mortality analysis, pricing, reserving and scenario tests. It also researches new areas such as digital underwriting or microinsurance. Risks arising from market fluctuations are managed through stress testing, model validation, and diversified investment strategies. Decisions based on data and analytical knowledge will ensure the long-term sustainability of the company.

Internal Control Department

The internal control team regularly reviews the company’s procedural work and operations to ensure compliance with the rules. When a problem is found, it is easy to take corrective action immediately. Strong internal controls prevent fraud and financial losses, and regular audits strengthen the company

‘s credibility.

Legal & Enforcement Department

The legal and compliance team helps the company operate fairly and within legal boundaries. It reviews contracts, monitors audits and prepares regulatory reports. By complying with the rules, the company avoids fines or legal risks. This helps to maintain the trust of customers and stakeholders.

Customer Service Department

The customer service team ensures efficient and flawless management throughout the life cycle of each insurance policy. It takes into account policy modifications, loans, surrenders, revival, premium adjustments and customer contact. Even a small mistake can bring great risk. Pay attention to it. Automation, real-time data checking, and a maker-checker process will keep the accuracy intact. Regular audits and quality reviews help to increase the credibility of the company.

Branding & Communication

The Branding and Communications Department focuses on building and preserving the company’s public image. Clear and transparent communication builds customer trust and a positive brand image. All messages are prepared and reviewed according to the standards. A crisis communication plan helps maintain the credibility of a company even in challenging situations.

Agency Recruitment & Training

The training department works to professionalize the employees and agents. It identifies learning needs and conducts training programs. Inadequate training can lead to compliance failures and inefficiencies. Training in the insurance sector also contributes a lot to prevent this. The insurance sector is very different from other sectors. If the company can make the employees timely, it will benefit not only the company but also the insured, agents and others. Most of the aforementioned departments have been in the company. The only thing that is new is whether everyone has cooperated to address the changing situation.

Risk Status

It would be pertinent to discuss some of the risks involved in the operation of the company. Risk is a situation where the outcome is different from the expected outcome. This means that the purpose for which the insurance company was started, whether the company has lived up to all the criteria or not. Any act of such deviation disables the operation of the insurance.

The Nepali market is more inclined towards bonus-oriented products. For this reason, agents sell policies without the features of the product or the need for the customer. Such practices put both the insured and the insured at risk. In a country like Nepal, where unstable interest rates have unstable interest rates, there is a possibility that high bonus rates may not be sustained in the long run.

Due to this, the bonus received by the insured is not uniform. Sometimes it’s less, sometimes it’s more. As a result, there is a risk of cancellation of the policy and the company losing the money invested in incentives and commissions. In addition, it also has a negative impact on the company’s reputation. Excessive emphasis on the same or similar products increases the concentration risk. To solve this problem, companies should spread awareness about various insurance products and increase financial literacy. This helps to gradually attract customers from traditional insurance products to diversified insurance products.

{{TAG_OPEN_strong_114}Product

Not paying enough attention to pricing can lead to low valuations, errors and insufficient premiums. Designing policies with more agents and higher premiums can sometimes lead to higher expenses for the company. Since the refund provision is rarely used in Nepal, the insurer suffers a huge financial loss when the policy is canceled initially. Here, the agent has already taken an advance commission. If there is a loss, it affects the insurance company.

No company can be made efficient immediately. To achieve efficiency, right practices and best policies should be adopted. Maintaining good governance, risk tolerance and making the monitoring system effective is the basis of efficient life insurance operations

The index of Nepal’s insurance market is focused on which company has the highest premium collection or how much life fund is there. In such a situation, the underwriting department is compelled to focus on collecting premium more than risk assessment. Premium collection is the liability taken by the insurance company. It has to be returned in some form later. Policies are issued without considering normal and unusual situations. Financial underwriting, which assesses a customer’s financial capacity and insurance needs, is often overlooked due to business pressures. This can damage reputations against money laundering and lead to national risks in the long run.

In the course of branch operations, there are sometimes irregularities such as personal involvement of employees, misuse of authority or financial manipulation due to selfishness, which puts the insurer at risk of operating and reputation. Delays or weaknesses in reconciliation in premium collection or other financial transactions are also indicative of a weakness in a company’s internal control system.

Investments made in personal interests, procurement processes or risky investments that do not match the vision, concept or nature of the product may lead to an imbalance in assets and liabilities. This can result in a reduction in bonuses and ultimately a dent in the company’s reputation. Similarly, improper reinsurance policies or excessive risk concentration in a single insurer can threaten the company’s reputation and overall financial stability.

The old core insurance system or the old software of the past is less dynamic and less innovative. In today’s digital age, such systems outperform the company compared to the competitor. When competitors adopt new and automated platforms, companies that rely on old software naturally lag behind.

This leads to operational inefficiencies, time consuming and increased operational risk. At the same time, inadequately trained employees and outdated work in the rapidly changing regulatory system and economic environment pose a big challenge to the company.

Insurers must keep up with new technologies and customer expectations to compete with industry standards, which in itself is a big challenge. Delays in claim processing, filing of false or fraudulent claims have a negative impact on public trust and increase operational and reputational risks. Conversely, a robust customer support system with clear and regular communication builds long-term trust and facilitates policy renewal, benefiting both the company and the insured.

The main job of the insurance company is to provide proper training to the agent. It benefits the company. When agents are trained to understand customer needs rather than sales, they are transformed more into the role of financial advisors than salespeople.

This motivates them to sell insurance policies tailored to customer needs. They are able to clearly explain the benefits to the insured and give realistic information. This satisfies the insured and reduces the chances of cancellation of the policy. In the long run, it builds a strong and sincere relationship between the company and the insured.

Building a strong brand image is a very important task for an insurance company. When a company is known to be efficient, transparent and well-governed, it easily wins the trust of customers, employees, regulators and investors. Reputation is the biggest strength for any company. It is an asset that helps a lot in expanding the business and maintaining public trust.

The company’s internal control system, compliance, legal, risk management and auditing departments play a big role in the success of the company.

If the work is independent and impartial, it will be easy to detect any problem in the beginning. This can solve the problem and prevent big risks. If there is no place for the regulator to ask questions, it will be easier to work. There will be no unnecessary disruption. This will protect the interests of all stakeholders.

When all departments, including marketing, underwriting, finance and risk management, work in a balanced and coordinated manner, the amount of capital required under the risk-based capital framework decreases. The principle is simple: the stronger and more controlled a company’s operating system, the less surplus capital has to be kept for potential risk. Under this system, the insurer has to allocate capital to cover a variety of risks – mainly market risk, counterparty risk and life insurance risk.

Additional capital is needed to cover the default risk of the counterparty in external relationships, including reinsurance arrangements, so that the insurer is protected. Life insurance risk includes factors such as increase in mortality, cancellation of policy, increase in expenses, operational weakness, etc. This adds uncertainty to future liabilities. increases the need for capital.

Operational efficiencies in insurance are the ability to visualize the ideal state of insurance and achieve it through continuous practice. No company can be made efficient immediately. To achieve proficiency, you need to adopt the right practices. Establishing sound policies and practices, maintaining strong good governance, risk tolerance and making the monitoring system effective are the foundations of efficient life insurance operations.

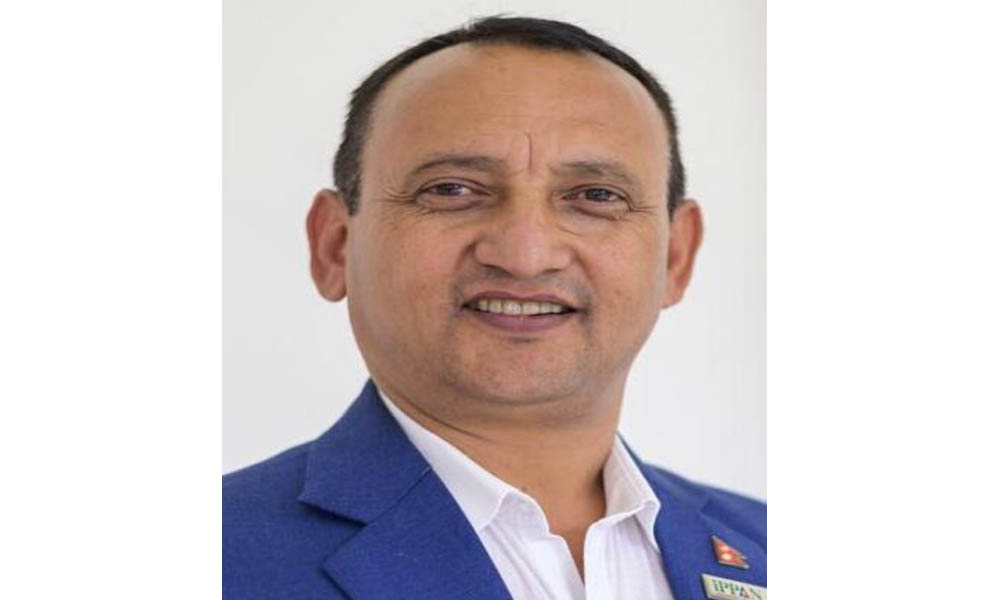

Roshan Prasad Gyawali, a fellow in insurance, is working as Chief Risk Officer at Sun Nepal Life.

(From the Economic Policy of the Society of Economic Journalists (SEJON))

प्रतिक्रिया दिनुहोस्