Kathmandu. The Securities Board of Nepal (SEBON) has remained silent on the issue of 92,800 units of shares sold by the chairman and two directors of the Ankhukhola Hydropower Company against the law.

SEBON has been silent on the name of the study being conducted for the past 1 year in the name of the sale of shares against the provisions of the Securities Act, Regulations and Directives. The company’s Chairman Ram Shrestha and its directors Ram Prasad Sapkota and Dinesh Prasad Shrestha sold 92,800 shares on different dates violating the Board’s law. However, the board is still studying.

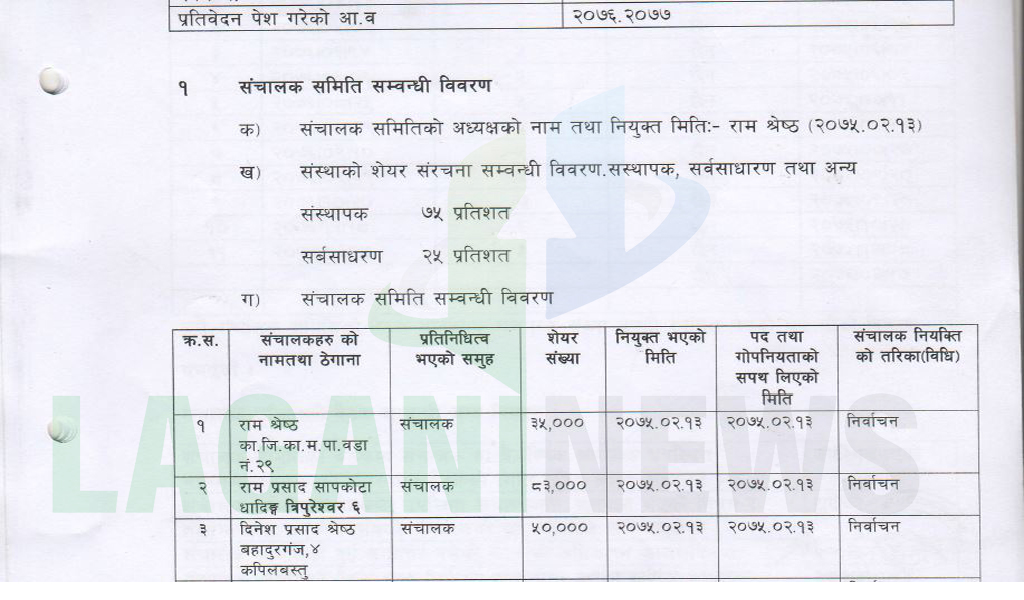

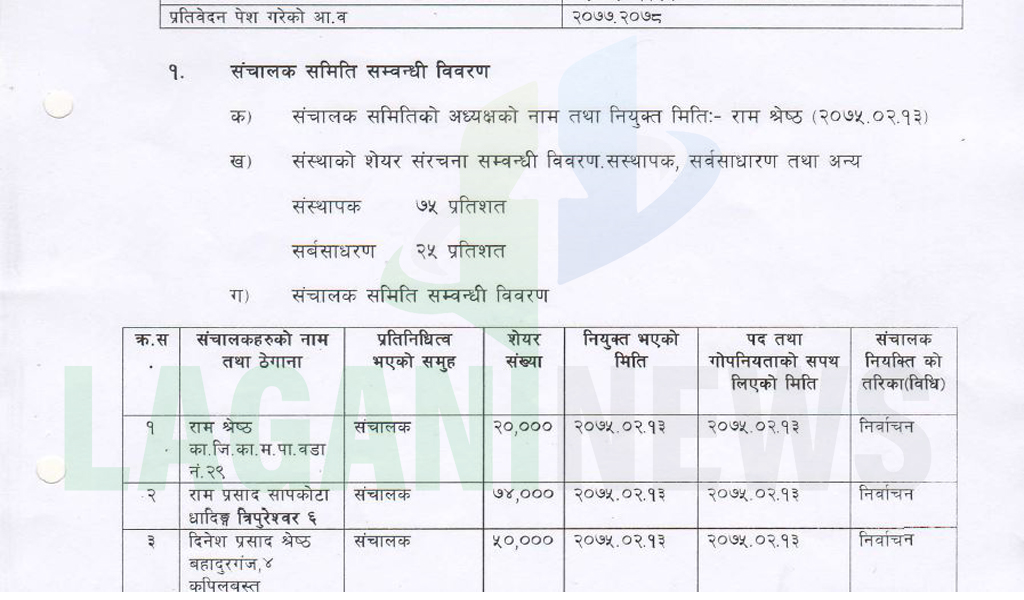

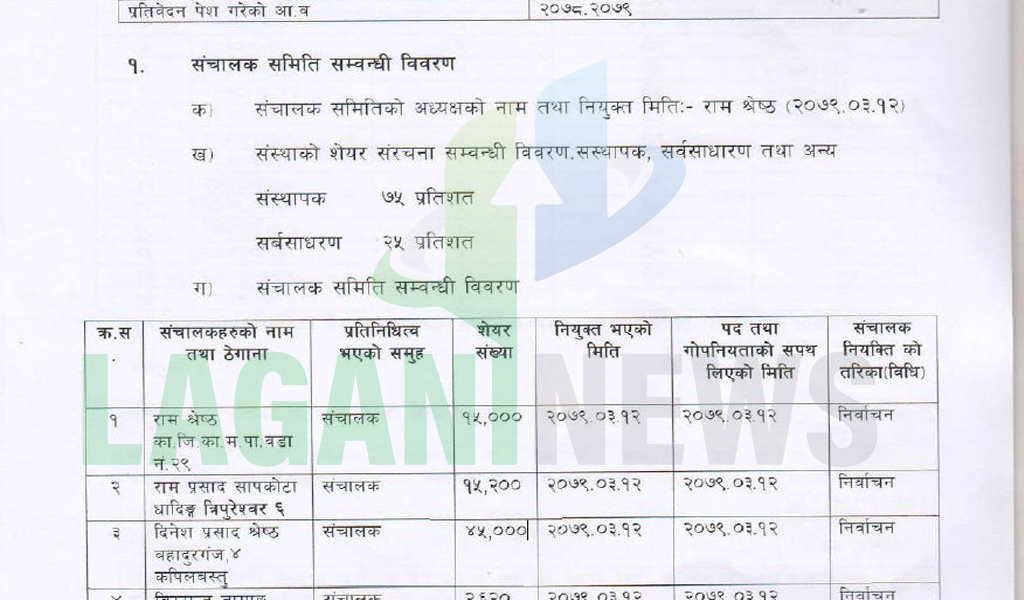

Shrestha became the chairman of the company on May 27, 2018. The company had issued the IPO on October 22, 2015. As of 2019, he owned 35,000 units of shares in the company. By 2077, he sold 15,000 units of shares owned by him to Rs 20,000. A year later, he sold 5,000 shares. Currently, he has only 15,000 units of shares.

Ram Prasad Sapkota, who was elected as a director along with Chairman Shrestha, had 83,000 units of shares as of 2076. In 2077, he sold 9,000 units of shares. It was only 74,000. By the end of 2078, he had sold 58,800 units of shares. 15,200 units. Currently, he has only 15,200 units. During this period, he sold 67,800 shares.

Similarly, another promoter Dinesh Prasad Shrestha had 50,000 units of shares in 2076. Two years later, he sold 5,000 units of shares. Currently, 45,000 units of shares are left. Chairman Shrestha and Director Sapkota sold their shares 2 times during their tenure. Another promoter Shrestha sold his shares once. The three are still the chairmen and directors of the company.

According to the Securities Registration and Issue Regulations-2073 BS and the Corporate Good Governance Directive-2074 BS, a listed company cannot buy or sell the shares of a listed company until they hold office and for one year after leaving office.

Rule 38 1 (a) of the Securities Registration and Issue Regulations, 2073 states: “A director, chief executive officer, auditor, company secretary or a person directly involved in the management or accounting functions of a body corporate, at the time of holding such office or the date of retirement from such position, shall sell securities of the concerned body or its subsidiary company for a period of one year, by himself or his family member or any other person or a firm under the control of such a person, No one shall buy, sell, transfer or transact in the name of a company or institution or to any other person.

However, the directors of Ankhukhol sold 92,800 units of shares during their tenure as a director. Similarly, Directive 14 (6) of the Corporate Good Governance Directive-2074 BS states that no person shall be allowed to buy and sell any shares or debentures of the company until he holds the post of director and for one year after his removal from the post. The regulations and guidelines prohibit the sale of shares for the period of directorship and 1 year after leaving.

The Securities Board of Nepal (SEBON) has violated its laws and has not seen the chairman and 2 directors of Ankhukhola sell their shares. Sebon has been saying that the shares sold by the chairman and director for about 5 years are being studied.

The Securities Board may, if it so desires, take action against the chairman and two directors of the Ankhukhola Hydropower Company for selling shares against the law, as per sub-section 7 of the penal punishment mentioned in Section 101 of the Securities Act.

Sub-section 7 states that the Board may impose a fine ranging from Rs 25,000 to Rs 75,000 on any person who violates the rules or by-laws framed under the Securities Act or any order or directive issued thereunder or the terms and conditions specified by the Board. Similarly, there is a provision to take action as per Section 108 of the Act for selling shares during the time of being a director.

Clause 108 of the Act states that if any director, general manager or any person holding the post of equivalent person receives any punishment pursuant to Section 101, such person shall not be eligible to hold the post of director, general manager or equivalent of any public limited, company or institution until the expiry of the period of 10 years from the date of imposition of such punishment.

Cebon’s own laws have not been enforced because of poor regulation by high-ranking officials. The board officials are currently silent on the issue. For the past 5 years, the employees of the board have been seen as silent when the chairman and director are trading shares against the law.

Niranjay Ghimire, spokesperson of the board, said that he has no information about what is happening in this matter. He said that anyone found violating the law would be brought to book.

प्रतिक्रिया दिनुहोस्