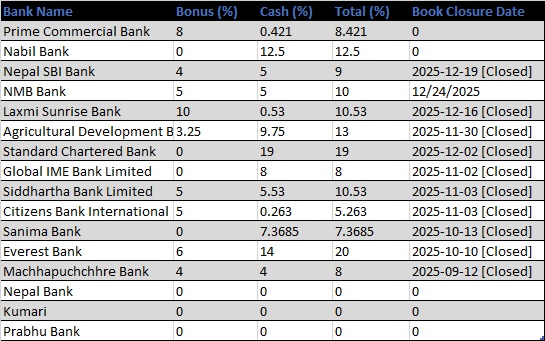

Prabhu Bank, Kumari Bank and state-owned Nepal Bank have left the investors’ hands empty from the profit of the last fiscal year.TAG_OPEN_div_76 Prime Commercial Bank, Nabil Bank, Nepal SBI, NMB Bank, Laxmi Sunrain, Krishi Bikas, Global IME Bank, Everest Bank, Machhapuchchhre Bank, Standard Chartered, Citizen, Sanima Bank and Siddhartha Bank have declared dividend so far. Some of the banks have called a meeting and approved the dividend fixed by the meeting.

13 commercial banks declare dividend

बाँकी बैंकको लाभांश क्षमता कति ?

Prime Commercial Bank has declared a dividend of 8.421 percent to its investors from the profit of the last FY.TAG_OPEN_div_74 The bank is issuing 8 percent bonus shares and 0.421 percent cash dividend for tax purposes.

प्रतिक्रिया दिनुहोस्