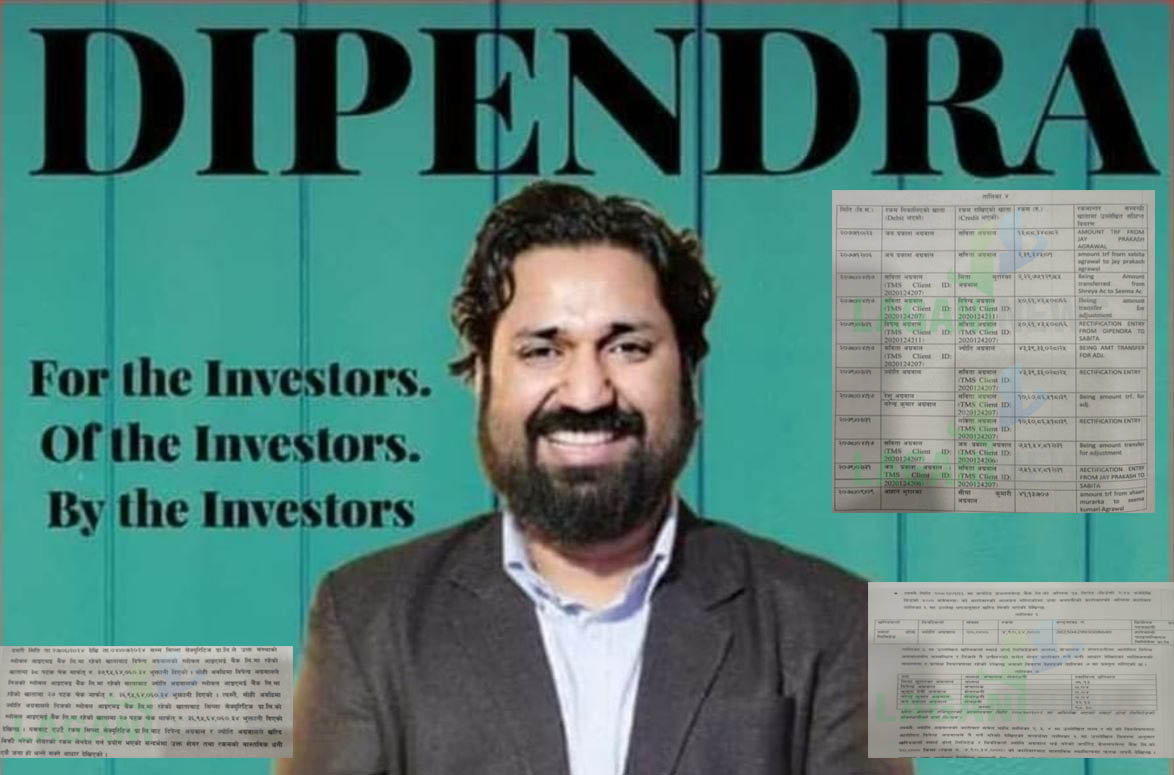

Kathmandu. Dipendra Agrawal, who has been enjoying share trading against the law, has been exposed to fraud. He is found to have been defrauding social media, brokers and about one and a half dozen people.

Agrawal, who was arrested by the Central Investigation Bureau (CIB) of Nepal Police on Friday, had been using various misinformation to cheat other investors for his earnings. He used the social network Facebook as a means to defraud investors. According to the investigation carried out by the Securities Board of Nepal (SEBON), Agrawal has earned a profit of Rs 4,TAG_OPEN_span_27 919,865 from Joshi Hydropower Company.

According to the preliminary investigation report of the Board, Agrawal had purchased the shares of Joshi Hydropower Development Company and sold the shares at a high price by issuing misleading information as per Section 97 (c) of the Securities Act, 2063.

Agrawal was found to have earned a profit of Rs. 49,19,865 against the law and was involved in mutual purchase and sale using other TMS and transactions between relatives and related organizations without changing the actual ownership. Agrawal had amassed 63,888 units of shares between Poush 24, 2080 BS and February 12, 2080.

After depositing the shares, Agrawal had spread misleading information on social media Facebook wall and messenger on February 15, 2080. According to the study, Agarwal sold all the shares on March 22, 2080.

According to the study conducted by the board, he earned a profit of Rs 49,19,865.90 during this period. This amount is against the law. According to the report, he has committed the offence of giving false details as per Section 97 (c) of the Securities Act, 2063.

Agrawal has been found to be using TMS not only of his own but also of 15 different individuals and companies while doing such transactions. According to a study conducted by Sebon, 15 TMS used by Agarwal belongs to his associates.

According to the study, he has been doing business under the names of Savita Agrawal, Dipendra Agrawal, Jyoti Agrawal, Jai Prakash Agrawal, Meeta Murarka Agrawal, Reshu Agrawal, Kusumdevi Agrawal, Ace Multipurpose Company, Narendra Kumar Agrawal, Ahan Murarka Agrawal, Ram Singh Saud, Man Kumari Gurung, Birendra Bahadur Saud, Goldman Investment and Seema Kumari Agrawal. He has used TMS in these names and has yet to settle a large amount of money with Shipla Securities. The dispute between Shipla and Dipendra had reached the Securities Board of India (SEBON).

The board’s study said, “The date is 27. 06. 2024 to 04. 07. Until 2024, Cipla Securities Pvt. Ltd. had transferred Rs. 38 cheques from the account of Dipendra Agrawal to the account of Global IME Bank. 37,95,64,060.34 Paid. During the period, Dipendra Agrawal transferred Rs 27 times from his account at Global IME Bank to Jyoti Agrawal’s account at Global IME Bank. Paid 36,95,64,060.34. Likewise, Jyoti Agrawal withdrew Rs. 27 cheques from his account at Global IME Bank to his account at Global IME Bank Ltd. It appears that payment of Rs. 36,95,64,060.34 has been made. This shows that the same amount was used to transact the shares bought and sold by Dipendra Agrawal and Jyoti Agrawal from Cipla Securities Pvt. Ltd. ’

On the other hand, Agarwal has been found to have artificially inflated the share price of Corporate Development Bank. Agrawal had traded 20,000 units of shares worth Rs 4,90,34,000 during the last 15 minutes of trading on April 30, 2082. The shares were sold by Jyoti Agrawal and bought by Smart Doors Limited. The transaction was found to have been done by him through Hatemalo Financial Services Pvt Ltd.

The chairman, director and shareholders of Smart Doors are related to Agrawal. The company was also controlled by Agrawal. The company’s chairperson is Mita Murarka Agrawal. He owns 76.13 percent of the shares in the company.

Similarly, Dipendra Agrawal owns 0.04 percent share, Kusum Devi Agrawal 0.04 percent, Narendra Kumar Agrawal 0.04 percent and Jaya Prakash Agrawal 22.13 percent.

According to the study, Jyoti Agrawal’s business was done by Dipendra Agrawal. According to a study conducted by the board, Agarwal has artificially increased the share price of Corporate Development Bank. As a result, it has been found to have committed the offence of false transaction and price influency under Sections 94 (a) and (b) and Section 95 of the Securities Act.

Further investigation into the case is underway, according to the Central Investigation Bureau (CIB) of Nepal Police. Agarwal has also been found to have cheated investors of Gorkhas Finance by spreading false information. Agrawal has been involved in this transaction from Hatemalo Financial Services Pvt. Ltd., Cipla Securities, South Asian Bulls and Shree Krishna Securities. Most of the transactions have been done by Shipla Securities.

प्रतिक्रिया दिनुहोस्