Kathmandu. Three broker companies have come under the scanner for helping stock trader Dipendra Agrawal who has been making huge amount of money through illegal means.

The board had investigated Agrawal after he made about half a crore from a single company by deceiving investors by spreading false information. The court has also recommended action against Agrawal and securities brokers Cipla Securities, Shree Krishna Securities and Hatemalo Financial Services with Rs 50 lakh in cash.

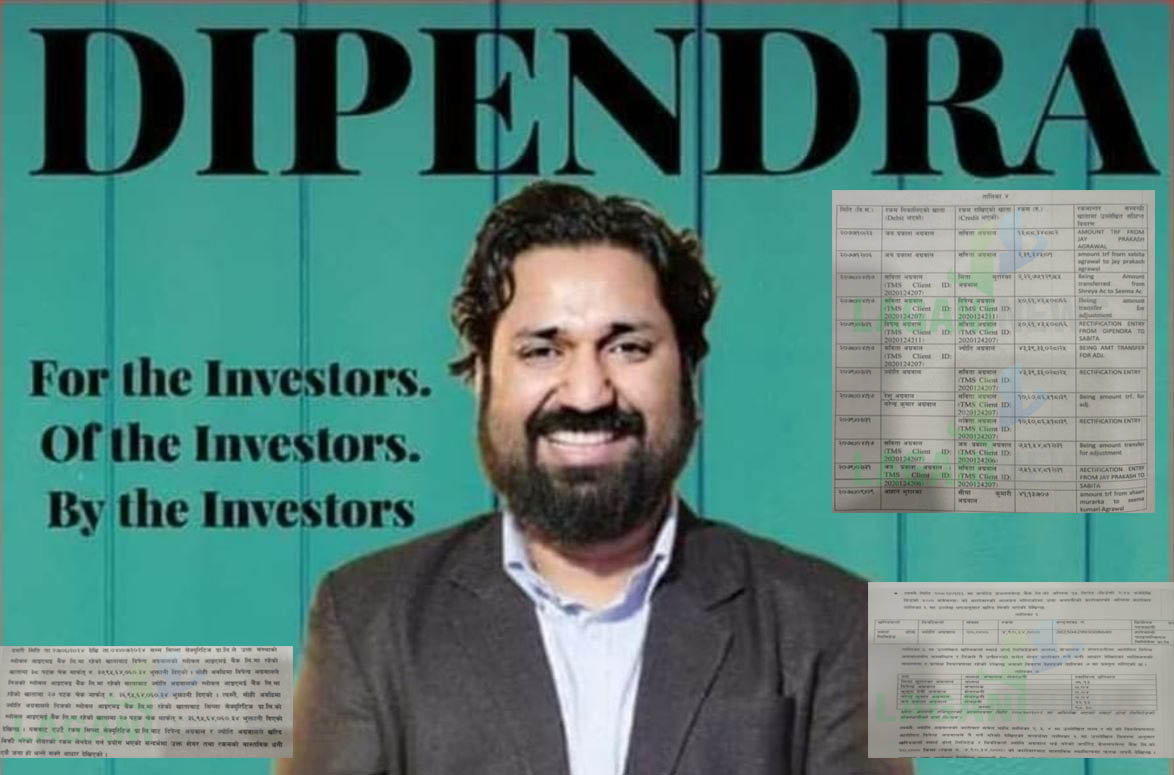

According to a study conducted by the Board, Agrawal has been involved in transactions in the name of 15 other individuals and organizations through the broker’s TMS in the letter submitted to the Board on June 11, 2081.

Although Cipla Securities (Pvt) was aware of the details of the real owner of the transactions, it was found that the company had not identified and confirmed the person who established the business relationship and transacted on behalf of other persons in accordance with the provisions of clause (d) of sub-section (4) of Section 7F (4) of the Prevention of Money Laundering Act, 2064 without updating it.

In view of the sub-section (3) of Section 7F of the Money Laundering Prevention Act, 2064, Cipla Securities (Pvt.) Ltd. The committee has also suggested imposing a fine of Rs 3 million as per clause (b) of sub-section (1) of Section 7F of the Money Laundering Prevention Act, 2064.

Likewise, securities broker Shree Krishna Securities has not been found to have established and confirmed the business relationship with other persons as per the provisions of clause (d) and clause 7 of sub-section (4) of Section 7A of the Money Laundering Prevention Act, 2064 ।

As a result, in view of the sub-section (3) of Section 7F of the Money Laundering Prevention Act, 2064, Shree Krishna Securities Ltd. Section 7F of the Money Laundering (Prevention) Act, 2064. It has recommended a fine of Rs 1 million as per clause (b) of sub-section (1).

Similarly, securities broker entrepreneur Hatemalo Financial Services Pvt. Ltd. Ltd. The company has not identified or confirmed the customer identity details of Jyoti Agrawal as per the provisions of clause (d) and clause (c) of sub-section (4) of Section 7 of the Money Laundering Prevention Act, 2064.

Section 7F of the Money Laundering Prevention Act, 2008 is expected to increase by Rs 116.83 per quintal as the closing price of the Corporate Development Bank (CDB) is expected to increase by Rs 116.83 on April 30, 2005. In view of sub-section (3) of the Act, Handmade Financial Services Pvt. Ltd. Ltd. The committee has recommended a fine of Rs 1 million as per clause (b) of sub-section (1) of Section 7F of the Money Laundering Prevention Act, 2064.

Similarly, Cipla Securities Pvt. Ltd. has also paid and received the amount to its clients Sabita Agrawal, Dipendra Agrawal, Jyoti Agrawal, Jaya Prakash Agrawal, Meeta Murarka Agrawal, Reshu Agrawal, Kusum Devi Agrawal, Ace Multipurpose Company, Narendra Kumar Agrawal, Ahan Murarka Agrawal, Ram Singh Saud, Man Kumari Gurung, Birendra Bahadur Saud, Goldman Investment Company and Seema Kumari Agrawal. It has not been allowed to be taken under Regulation 16 and 17 of the Act, 2069. The committee has recommended the maximum penalty to the institution as per Section 101 (6) of the Securities Act, 2063.

A study conducted by the board has recommended that the securities broker entrepreneur Hatemalo Financial Services Pvt. Ltd. violated the provision of the bylaws by not accepting the advance amount to be taken as per the Securities Trading Operation Byelaw-2075 while giving the transaction limit to the customer of the organization, Jyoti Agrawal, on the basis that the transaction limit was not mentioned as per the date ।

According to the study, Agrawal has signed a contract with Joshi Hydropower Development Company Ltd. It is seen that the shares of the company were purchased and collected before making misleading information public, the market has increased and the shares have been sold at a higher price.

During this period, he was a member of Joshi Hydropower Development Company Ltd. The company bought 73,307 units of shares at an average price of Rs 275.74 and traded at an average price of Rs 342.85. He has earned a profit of Rs 67.11 per share. He has earned a profit of Rs 49,19,865.90 from this transaction. There is evidence to prove that Agrawal has committed the offence of furnishing false statements under Section 97 (c) of the Securities Act, 2063.

According to the bank account details of Dipendra Agrawal and Jyoti Agrawal, Agrawal used the same amount in the transactions of the 15 participants. As a result, there is no real change in the transactions between them. As a result, there is a basis to prove that the fraudulent transaction was carried out pursuant to clause (a) of Section 94 of the Securities Act, 2063.

According to the study, Smart Doors Limited and Jyoti Agarwal were the buyer and Jyoti Agarwal was the seller of the deal. Similarly, the transaction of 20,000 units of shares of Corporate Development Bank worth Rs 4,90,34,000 will not affect the actual ownership.

The said transaction was found to be a fraudulent transaction as per clause (a) and (b) of Section 94 of the Securities Act, 2063 and the final value of the Corporate Development Bank was increased by Rs. 116.83 on April 30, 2002.

This shows that the offence under Section 95 of the Securities Act, 2063 has been committed. According to the report, it would be appropriate to submit the details and files collected as per the sub-section (3) of Section 103 of the Securities Act, 2063 to the Police Headquarters for investigation into the said offences.

प्रतिक्रिया दिनुहोस्