Kathmandu. KATHMANDU: Nepal Rastra Bank (NRB) has decided to reduce the share capital of the shareholders of Karnali Development Bank.

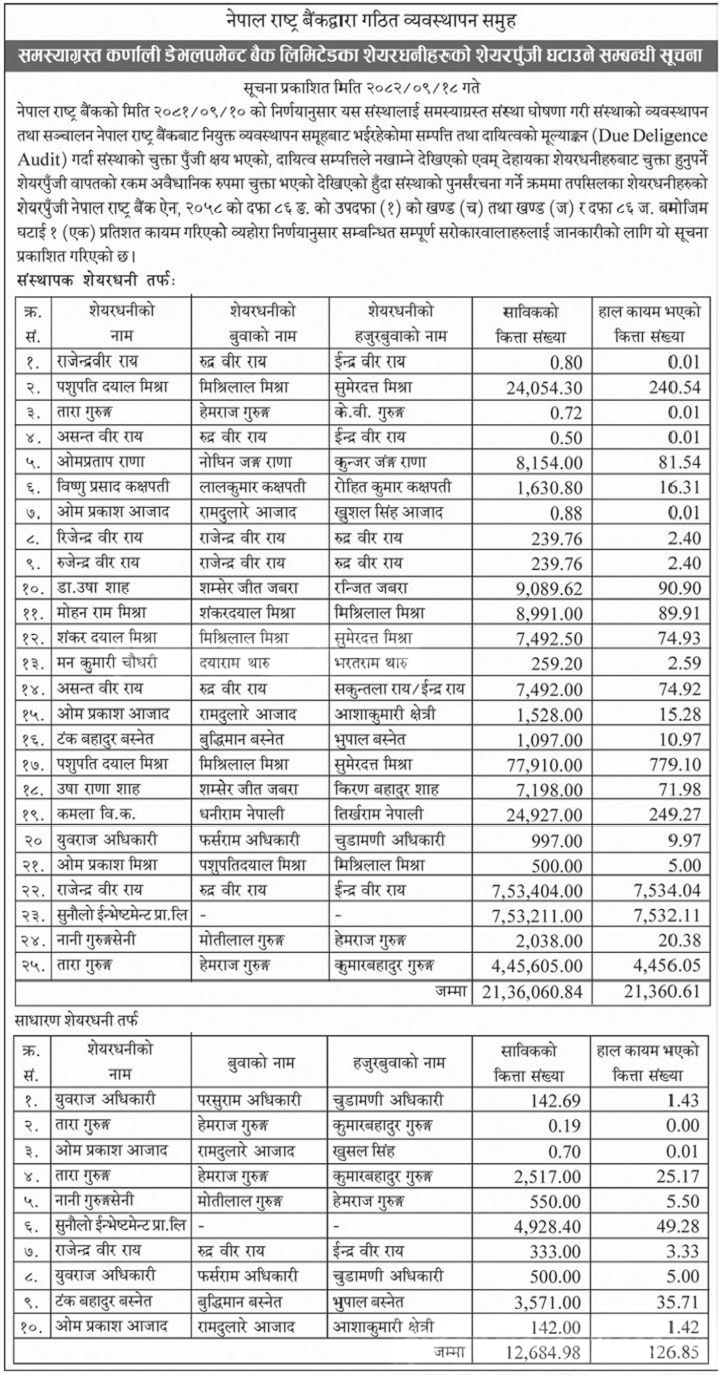

The management group formed by the Nepal Rastra Bank (NRB) has decided to reduce the share capital of 25 promoter shareholders and 10 ordinary shareholders.

Currently, the promoter has 2,136,060 units and the ordinary shareholders have 12,684 units. Both of them have 2,148,744 shares. Nepal Rastra Bank (NRB) has set aside 21,360 units of promoter and 126 units of general public. Both the groups will now have 21,486 shares.

As per the decision of the Nepal Rastra Bank on December 26, the company was declared a problematic organization and the management and operation of the organization was being carried out by the management group appointed by the Nepal Rastra Bank.

It has been found that 25 shareholders have illegally paid the amount of share capital that should have been paid.

The share capital of 35 shareholders has been reduced to 1 percent as per clause (f) and clause (h) and clause 86 (h) of Section 86E of the Rastra Bank Act, 2058.

प्रतिक्रिया दिनुहोस्