Kathmandu. In the last fiscal year, 11 hydropower companies got permission from the Securities Board of Nepal to issue right shares. These companies issued right shares worth Rs 8.44 billion.

The listed companies issue rights shares in accordance with the provisions of the Securities Act, 2063 and the Companies Act, 2063. In the case of a hydropower company, permission should also be obtained from the Electricity Regulatory Commission while issuing right shares.

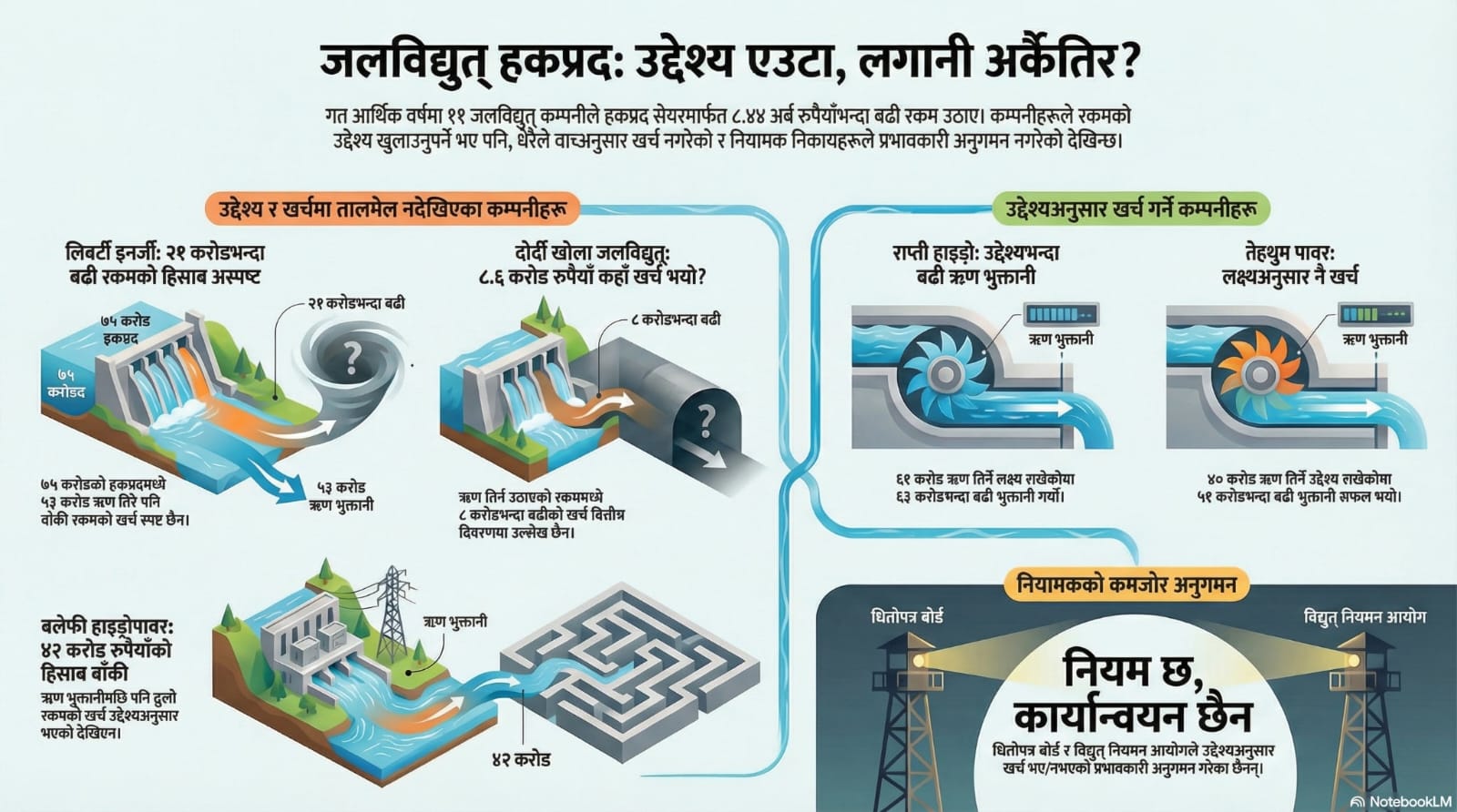

While issuing right shares, the hydropower company should submit the total amount and the title of the amount to be spent to the Securities Board. The right shares can be issued only after the approval of the board. However, the regulatory body does not seem to have paid attention to whether the amount received for the right shares has been spent for the purpose mentioned by the company in the prospectus.

Among the hydropower companies that got permission from the Board to issue right shares in the last fiscal year, People’s Power and Khanikhola Hydropower did not get the details. The remaining nine companies have spent as per the objectives stated in their prospectus. Some companies have invested as per the objective while some companies have not invested as per the objective.

Joshi Hydropower

Joshi Hydropower Company Limited has issued right shares in the ratio of 1:0.65 of its paid-up capital. The company had issued 24,14,100 units of right shares at a face value of Rs 24,14,10,000 at the rate of Rs 100 per share, 65% of the paid-up capital of the company. Prior to the right issuance, the paid-up capital of the company stood at Rs 37.14 crore and after that it reached Rs 61.28 crore.

The company had intended to repay the loan taken for the 3 MW Upper Puwa-1 hydropower project.

The company had planned to repay Rs 155.71 million in principal and interest on loans taken from various banks and financial institutions and Rs 56,835,195 as loan taken from its founder Birendra Bahadur Neupane. Apart from this, the company had to spend Rs 2,88,64,804 for the maintenance of physical infrastructures in the project.

The company had liabilities to pay Rs 133,113,439 from the fiscal year 2078/79 to the fiscal year 2080/81. There is no information in the financial statement whether the amount raised for the purpose of paying the liability was spent accordingly or not. The company has not disclosed its financial results for the first quarter of the current fiscal year. Chief Executive Officer (CEO) of the company, Sudhir Lamichhane, claimed that the company spent the money as per the objective of issuing the right shares. According to him, the company had a bank loan of Rs 13,31,13,439 at the time of preparing the prospectus for the right shares. In the first quarter of the current fiscal year, the loan amount has decreased to Rs 11.5 crore.

Liberty Energy Company

Liberty Energy Company had issued right shares in the ratio of 1:0.5 from December 2, 2081. After the issue of right shares worth Rs 750 million, the paid-up capital of the company has reached Rs 2.25 billion. The company had taken loan of Rs 5.159 billion from six banks and financial institutions for the 25 MW Upper Dordi A Hydropower Project till mid-July 2081.

According to the company’s details, long-term loans stood at Rs 4.89 billion and short-term loans stood at Rs 4,09,66,054 as of mid-January 2081. Three months later, in mid-April, the company’s long-term loan was reduced by Rs 53,38,34,857 to Rs 4,35,98,98,06,579. In the first three months, the company has repaid a loan of Rs 53,38,34,857. However, short-term loans have not decreased during this period.

Short-term loans have increased from Rs 4,09,66,054 in mid-January to Rs 16,37,66,054 after three months. Looking at the details of mid-April, the company has reduced long-term debt of Rs 53.38 crore by issuing rights shares worth Rs 750 million. Dhruba Kumar Shrestha, company secretary of Liberty, said that the amount has also been paid to the construction company. The remaining Rs 21,61,65,143 received from the right issue was not spent on loan repayment.

During this period, the company has paid some amount for the purchase of goods and services. As of mid-January, the trade payable was Rs 3,01,36,057. It had declined by Rs 2,26,08,491 to Rs 7,527,566 in mid-April. The company was yet to spend Rs 19,35,56,652 as per its objective after spending the right amount on long-term loans and trade payables.

The company on April 31, 2005 had received the project from the Department of Power Development for the production of electricity from the 24.6 MW Badigad Khola Hydropower Project. Rs 120.5 million has been spent on the project. The amount of right shares is Rs 7,30,27,652. Company Secretary Shrestha said that the remaining amount has been invested in other projects.

However, it is not clear how much amount for which project as of mid-April last fiscal year. Shrestha claimed that the money received from the right issue was spent as per the objective. After the issuance of right shares, the company will repay some of the loans taken from various banks for the construction of Upper Dordi ‘A’ Hydropower Project and the remaining amount will be invested in the construction of Upper Dordi ‘A’ Hydropower Project and other projects promoted by the company.

Balefi Hydro

Balefi had issued 1,82,79,700 units of right shares worth Rs 1,82,79,70,000 in the ratio of 1:1 from December 11, 2081 to January 1, 2081. After the issuance of right shares, the paid-up capital has reached Rs 3.65 billion.

The auction started selling 17,98,656 units of unsold right shares since February 19 after the applications for the right shares were not received as per the demand. The deadline to apply was March 19.

Balefi’s long-term debt stood at Rs 6.56 billion in mid-January and Rs 5.60 billion stood at Rs 5.60 billion by mid-April. The short-term loan had increased from Rs 1,43,16,900 in mid-January to Rs 3,750,962 in mid-April. Short-term loans decreased by Rs 1,05,66,028 during the period. Other liabilities decreased from Rs 12,68,948 to Rs 8,81,804 to Rs 3,87,144. During the period, the company spent Rs. 972.957 million on long-term, short-term loans and other liabilities.

The company was supposed to spend Rs 1.40 billion to repay the long-term bank loan taken during the construction of the project. The remaining Rs 42,70,42,168 will remain after spending on long-term, short-term loans and other liabilities. The company said it has spent Rs 37,44,87,890 under the head of intangible assets under development. Still Rs 5,25,54,278 is still pending.

The company had said that it would spend Rs 30,64,46,860 to fully repay the loan taken from the promoters at different times to avoid shortage of capital during the project construction. It has said that it will spend Rs 12,15,23,139 to pay the various construction companies and vendors involved in the construction of the project.

Barun Hydro

Barun Hydropower Company had issued right shares from July 14 to August 2. The company is issuing 53,58,150 units of right shares at a price of Rs 100 per share in the ratio of 1:1. The company had sold 2,38,443 units of unsold shares through secret shield tender from September 12 to September 26 after the application was not received within the stipulated time.

After the right issuance, the paid-up capital of the company was expected to reach Rs 1.07 billion. However, it is Rs 1,04,77,86,700.

For the purpose of issuing the right shares of the company, the amount of Rs. 535.8 million was to be used for the reconstruction of the Hewa Khola Small Hydropower Project which was completely damaged by the flood and landslide on June 15, 2080 as well as for the construction and operation of the project of Jalshakti Hydro Company Pvt. Ltd.

The Jal Shakti Hydro Company Pvt Ltd was supposed to spend Rs 15.8 million of the total damage caused by the floods and landslides. The acquisition cost is Rs 52 crore as per the technical study and the suitability to acquire the project as it is. It is estimated that Rs 4.91 billion will be required for the construction of the hydropower project.

In the month of July, the trend and other payable was Rs 3,49,94,997. It has decreased by Rs 1,75,12,838 in mid-October. This amount is Rs 1,74,82,159. According to the prevailing law, if other taxes including profit tax have to be paid, the tax will be paid to the concerned body. The TDS payable was Rs 29,51,783 in mid-July. This amount was Rs 32,56,253 in mid-October.

Ngadi Group Power Company

Ngadi Group Power Company had issued right shares worth Rs 1.85 billion from January 7, 2081. After the issuance, the company’s paid-up capital has reached Rs 3.70 billion. While issuing the right shares, it was said that Rs 1.81 billion will be invested in the Upper Seti Hydropower Project (216 MW) promoted by Samriddhi Energy. Similarly, Ngadi Group Power Limited was supposed to spend Rs 1.85 billion including Rs 32.5 million for the maintenance and maintenance of the project.

Out of this, Rs 32.77 lakh will be allocated for the maintenance and maintenance of the project promoted by Ngadi Group Power Limited and Rs 2,92,23,000 for the maintenance and maintenance of civil works. The total amount was Rs 3.25 crore.

As of mid-April of the last fiscal year, 20,42,950 rupees have been spent under the head of payable. It is not clear in the report that a total of Rs 30,4,57,050, including Rs 2.92 crore was spent on the maintenance and maintenance of civil works. TDS payable has been reduced by 20,06,707. The cost of TDS payable and payable is Rs 40,49,657. Still, the details of the expenditure of Rs 2,64,07,393 have not been clearly shown.

Dordi Khola

Dordi Khola Hydropower Company had issued 1:1 right shares worth Rs 1.05 billion from April 2, 2081 to April 28, 2082. After the issuance of the right shares, the paid-up capital of the company was expected to reach Rs 2,10,85,20,800. Presently, the company has a paid-up capital of Rs 2.09 billion.

According to the company, the purpose of issuing right shares is to repay the loans taken from various banks. The proceeds from the right share issue will be partially paid off by the consortium banks of the project, which is operating the company. The amount received from the right issue will be Rs 68,64,42,948 after partial payment of the bank’s loan.

As of mid-April 2081, the company’s long-term loan stood at Rs 1.73 billion. After the issuance of the right shares, the company repaid a long-term loan of Rs 942.9 crore. The outstanding loan stood at Rs 790,09,19,698 as of mid-July 2018.

During this period, the company has repaid all short-term loans i.e. Rs 2.5 crore. Both the loans were paid Rs 96,79,85,828. The bank said that the bank will maintain a loan of Rs 68,64,42,948 after the repayment of the said amount while issuing the right shares. However, Rs 79,09,19,698 is left in the report. This company has not reduced the loan as stated in the objective. The company has not clearly mentioned where it has spent the remaining Rs 8,62,74,572 after repaying the bank’s loan after the issuance of right shares.

Chhyangi Hydropower

}

Chyangdi Hydropower Company Limited has issued 100% right shares i.e. Rs 3869,77,500 for the period from June 6 to July 25. After the issuance of the right shares, the paid-up capital of the company has reached Rs 77.39 crore.

The company intends to pay the remaining du÷es to the creditors out of the amount of Rs 386.97 million out of the amount received by issuing right shares in the ratio of 1:1. The company owed Rs 4 crore. As per the bank’s request, Rs 196.977 thousand 500 was to be paid for the long-term loan amount of the Upper Chhandi Khola Small Hydropower Project and Rs 150 million to invest in the 57.5 MW Nupche Likhu Hydropower Project promoted by Vision Energy and Power. The plan was to utilize the loan of Rs 38 crore 69 lakh 77 thousand 500 for both the projects.

Prior to the issuance of right shares, the company’s long-term debt stood at Rs 74,60,30,711 as of mid-July of the last FY. After the issuance of right shares, the company’s long-term debt of Rs 64,46,50,645 stands in the first quarter of the current fiscal year. During the period, the company repaid Rs 10,13,80,065 by issuing right shares.

The short-term loan stood at Rs 26,39,62,500 as of mid-July. Such loans stood at Rs 3,89,62,500 at the end of October. During this period, the company has repaid short-term loans of Rs. 22.50 crores. The company has repaid a loan of Rs 32,63,80,065 in the short term and long-term. The company had issued right shares worth Rs 38,69,77,500 to repay the loan.

According to the company’s details, it has been paid only Rs 32,63,80,065. The remaining expenditure of Rs 605,97,435 has not been shown in the financial condition. The purpose of the company was to repay the loan taken for 2 projects. She doesn’t seem to be in line with that. Not all companies spend as per the purpose, and the title of the expenditure is not clearly disclosed. Some companies have issued right shares for the purpose of spending. They have spent on the same title.

Rapti Hydro and General Construction and Tehrathum Power Company have been selected to spend as per the objectives submitted to the Board. These companies have spent on the purpose for which they have issued the right shares.

Rapti Hydro & General Construction

Rapti Hydro and General Construction Company had issued 100% right shares of its paid-up capital for the period of July 1 to July 7, 2082. The company had issued Rs 61,27,93,800 right shares at the rate of Rs 100 per share. After the right issuance, the paid-up capital of the company has reached Rs 1,225,55,87,600.

The company has issued a right share of Rs 61,27,93,800 to pay the principal and interest of the banks and financial institutions while issuing the right shares. The company aims to partially repay the loans of various banks and financial institutions using the amount from the right shares. The company had taken loans from banks and financial institutions under the aegis of Prime Commercial Bank.

As of mid-April 2081, Prime Commercial Bank’s loan stood at Rs 69,62,67,017. Similarly, Kumari Bank and Prabhu Bank had a total of Rs 14.56 crore and Rs 123,9248. It had said that the loan of Rs 61,27,93,800 would be repaid. However, the company has paid Rs 63,64,29,378. It was said that the loan amount to be maintained after partial payment from the right issue would be Rs 35,27,28,357. As of mid-October, it is less than Rs 32,31,03,110. The company has also repaid a short-term loan of Rs 2 crore. This company has worked as intended. The company is currently constructing the Rukumgad Hydropower Project with a capacity of megawatt capacity. Its cost is Rs 61,27,93,800.

Tehrathum Power Company Limited

Terhathum Power Company had issued 100 percent right shares for the period from July 2 to July 19. The company has issued 100 percent right shares worth Rs 40 crore. After the issue of right shares, the paid-up capital of the company has reached Rs 80 crore.

The bank had borrowed Rs 926.137 million from Machhapuchchhre Bank, Nabil Bank and Global IME Bank. The government had planned to pay Rs 160 million from the right shares to Machhapuchchhre Bank, Nabil Bank and Global IME Bank Rs 120 million.

According to the financial report published in the first quarter of the current FY, the company has repaid a loan of Rs 51.76 crore. The company has spent the right shares according to the purpose for which it has issued.

The company has also developed 2 MW Khorunga Tangmaya Hydropower Project. So far, no agency has asked the companies why they have not spent as per the objective. Joint Spokesperson of the Securities Board of Nepal Tolakanta Neupane said that the listed companies should invest only in the specified areas as per the objective. According to him, all companies have to submit all the details of Sebon every year.

Clause 13 (3) of the Securities Issue and Allotment Directive-2074 states, “If a corporate entity invests the amount received from the issuance of right shares in another company or subsidiary company, such amount shall be deposited in a separate bank account and submitted the details to the Board.” However, no details were available from Sebon. Similarly, 45 of the same directive states that information should be given if it is different from the prospectus.

Clause 1 of 45 states, “If there is a difference of 15 percent or more in the details projected in the prospectus, the provisions relating to the issue of right shares, the prospectus book or other details, the reasons therefor.” The organization has to inform the board. Clause 2 of 45 states that “the details and information of the projector shall be included in the forthcoming annual report of the organization and published”. The Securities Board has not paid proper attention to this. The board officials are silent on this matter.

Officials of the Electricity Regulatory Commission (ERC) also said that they have received complaints of anomalies in the name of right shares. However, the Commission has not paid any attention to the issue of whether the right shares are to be spent according to the title on which it is supposed to be spent. CIAA Information Officer Hari Bahadur Khatri said the commission would look into the matter with keen interest.

प्रतिक्रिया दिनुहोस्