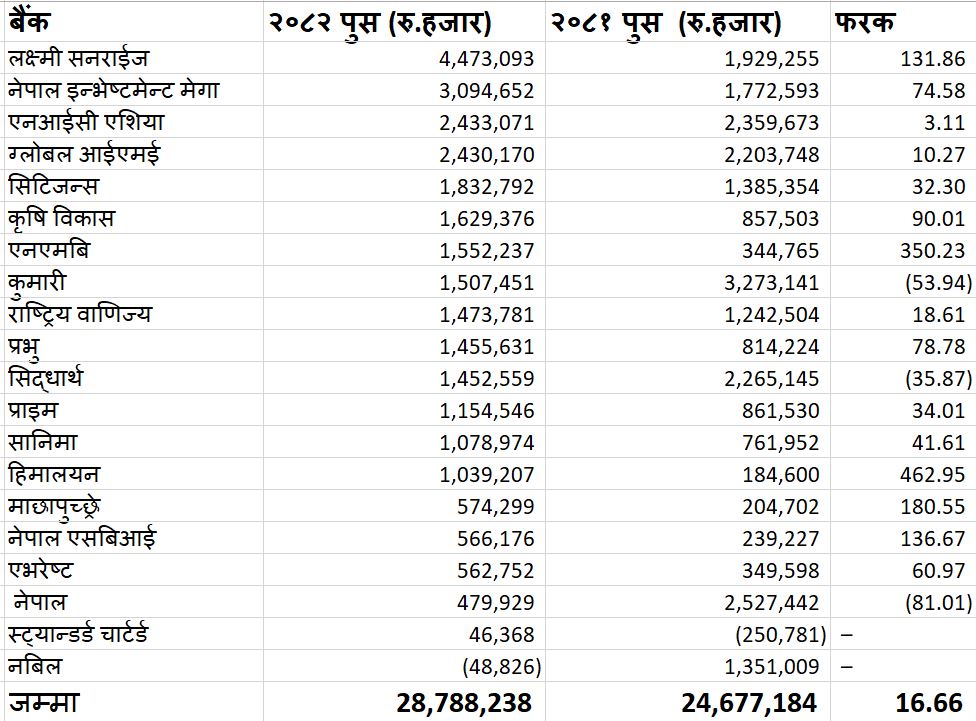

Kathmandu. The amount allocated to 20 commercial banks for loan loss management has increased by 16.66 percent in the second quarter of the current fiscal year.

The bank had set aside Rs 24.67 billion for loan loss management till mid-January of the last fiscal year. Such amount has reached Rs 28.78 billion in the same period of the current fiscal year.

As the bad loans of banks are increasing, the amount set aside for potential risk is also increasing. In the second quarter of the current fiscal year, the NPAs of banks increased by 0.59 percent to an average of 5.08 percent. It was 4.49 per cent in the same period last year.

The graph of bad loans is increasing due to the failure of banks to recover loans on time. At the same time, the amount of money that banks have to set aside for potential loan loss is also increasing.

With the increase in the non-performing loans of the banks, a large amount of money has to be allocated for the loan loss management. Laxmi Sunrise Bank has allocated the highest amount of Rs 4.47 billion for loan loss management. This is 131.86 percent more than the same period last year.

Similarly, Nepal Investment Mega Bank is the second bank to allocate the highest amount of loan loss management. The amount allocated by the bank increased by 74.58 percent to Rs 3.09 billion compared to the same period of the last FY.

Similarly, NIC Asia Bank has a loan loss management of Rs 2.43 billion. Global IME Bank’s loan loss management increased by 8.91 percent to Rs 2.43 billion, Citizens Bank by 32.30 percent to Rs 1.83 billion, Agricultural Development Bank by 90.01 percent to Rs 1.62 billion and NMB Bank by 90.01 percent to Rs 1.62 billion and NMB Bank’s

}

It increased by 350.23 percent to Rs 1.55 billion.

Similarly, the loan loss of Kumari Bank has increased by 53.94 percent to Rs 1.50 billion, Rastriya Banijya Bank by 18.61 percent to Rs 1.47 billion, Prabhu Bank by 78.78 percent to Rs 1.45 billion and Siddhartha Bank by 35.87 percent to Rs 1.45 billion. Prime Bank Ltd surged 34.01 percent to Rs 1.15 billion while Sanima Bank surged 41.61 percent to Rs 1,078.94 million.

Similarly, Himalayan Bank has increased by 462.95 percent to Rs 1.03 billion, Machhapuchchhre Bank by 180.55 percent to Rs 574.29 million, Nepal SBI Bank by 136.67 percent to Rs 566 million and Everest Bank by 60.97 percent to Rs 562.75 million and Nepal Bank by 81.01 percent to Rs 47.99 million.

Standard Chartered Bank has issued a provision writeback of Rs 4,63,68,000 while Nabil Bank has issued a provision writeback of Rs 4,88,26,000.

प्रतिक्रिया दिनुहोस्