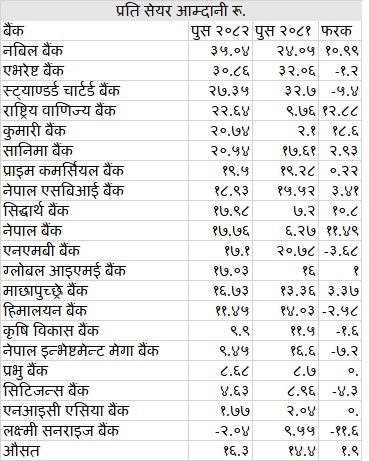

Kathmandu. In the second quarter of the current FY, the bank’s earnings per share stood at Rs 16.30. The bank’s earnings per share increased by 1.90 paise compared to the previous year. In the second quarter of the last FY, the bank’s income was Rs 14.40.

Nabil Bank is the bank with the highest earnings per share in the second quarter of the current FY. The income of the bank is Rs 34.04. The bank’s earnings per share increased by Rs 10.99 compared to the same period last FY. In the second quarter of the last FY, the bank’s income was 24.05 paise.

Everest Bank is the second highest earner per share. The bank has EPS of Rs 30.86 per share. The bank’s earnings per share decreased by Rs 1.20 compared to the same period last FY. In the second quarter of the last FY, the bank’s income was Rs 32.06.

Similarly, Standard Chartered Bank has EPS of Rs 27.35 per share. The bank’s earnings per share decreased by Rs 5.40 compared to the same period last year. Such income was Rs. 32.70 in the same period of the previous year.

Rastriya Banijya Bank has a net profit of Rs 22.64 per share. The bank’s income increased by Rs 12.88 per share. In the previous year, such income was Rs 9.76.

Kumari Bank has a net profit of Rs 20.74 per share. The bank’s earnings per share increased by Rs 18.60 compared to the corresponding period of the last FY. Last year, the income was Rs 2.10.

During the period, Sanima Bank earned Rs 20.54 per share. The bank’s income increased by Rs 2.93 per share. It was Rs 17.61 a year ago.

Prime Commercial Bank has a net profit of Rs 19.50 per share. The income of the bank increased by Rs 0.22. Last year, it was Rs 19.28.

Nepal SBI Bank has a net profit of Rs 18.93 per share. The bank’s income increased by Rs 3.41 per share. Last year, it was Rs 15.52.

Siddhartha Bank’s earnings per share stood at Rs 17.98. The income of the bank increased by Rs 10.80. Last year, it was Rs 7.20.

Nepal Bank has a net profit of Rs 17.76 per share. The income of the bank increased by Rs 11.49. Last year, it was Rs 6.27.

NMB Bank has EPS of Rs 17.10 per share. The bank’s income decreased by Rs 3.68. Last year, it was Rs 20.78.

Global IME Bank’s earnings per share has reached Rs 17.03. The income of the bank has increased by Rs 1. Last year, it was Rs 16.

Machhapuchchhre Bank has a net profit of Rs 16.73 per share. The bank’s income increased by Rs 3.37 per share. Last year, it was Rs 13.36.

The bank has EPS of Rs 11.45 per share. The bank’s income decreased by Rs 2.58. Last year, it was Rs 14.03.

The bank has a net profit of Rs 9.90 per share. The income of the bank decreased by Rs 1.60. Last year, it was Rs 11.50.

Nepal Investment Mega Bank (NIBL) has a net profit of Rs 9.45 per share. The bank’s income decreased by Rs 7.20. Last year, it was Rs 16.60.

Prabhu Bank has EPS of Rs 8.68 per share. The bank’s income has remained stable. Last year, it was Rs 8.70.

Citizens Bank’s earnings per share stood at Rs 4.63. The bank’s income decreased by Rs 4.3 crore. Last year, it was Rs 8.96.

NIC Asia Bank has a net profit of Rs 1.77 per share. The bank’s income decreased by Rs 0.27. Last year, it was Rs 2.04.

Laxmi Sunrise Bank has a net profit of Rs 2.04 per share. The bank’s income decreased by Rs 11.6 percent. Last year, it was Rs 9.55.

प्रतिक्रिया दिनुहोस्