Kathmandu. A separate specialized regulatory body will be formed to regulate and monitor the major non-banking financial institutions of the country such as Employees Provident Fund, Citizen Investment Trust and Social Security Fund.

The five-year financial sector development strategy ‘Fiscal Year 2082/83 to 2086/87’ has presented a clear roadmap for the establishment of a separate institutional mechanism for the establishment, operation and regulation of non-banking financial institutions.

The meeting of the Council of Ministers held on January 12 has already approved the strategy. The strategy aims to make the financial system stronger, stronger and inclusive and contribute to long-term economic prosperity.

Employees Provident Fund, Citizen Investment Trust and Social Security Fund play an important role in Nepal’s financial system. Savings, pensions and social security contributions of millions of citizens involved in the government, public, private and self-employment sectors have been collected in this fund.

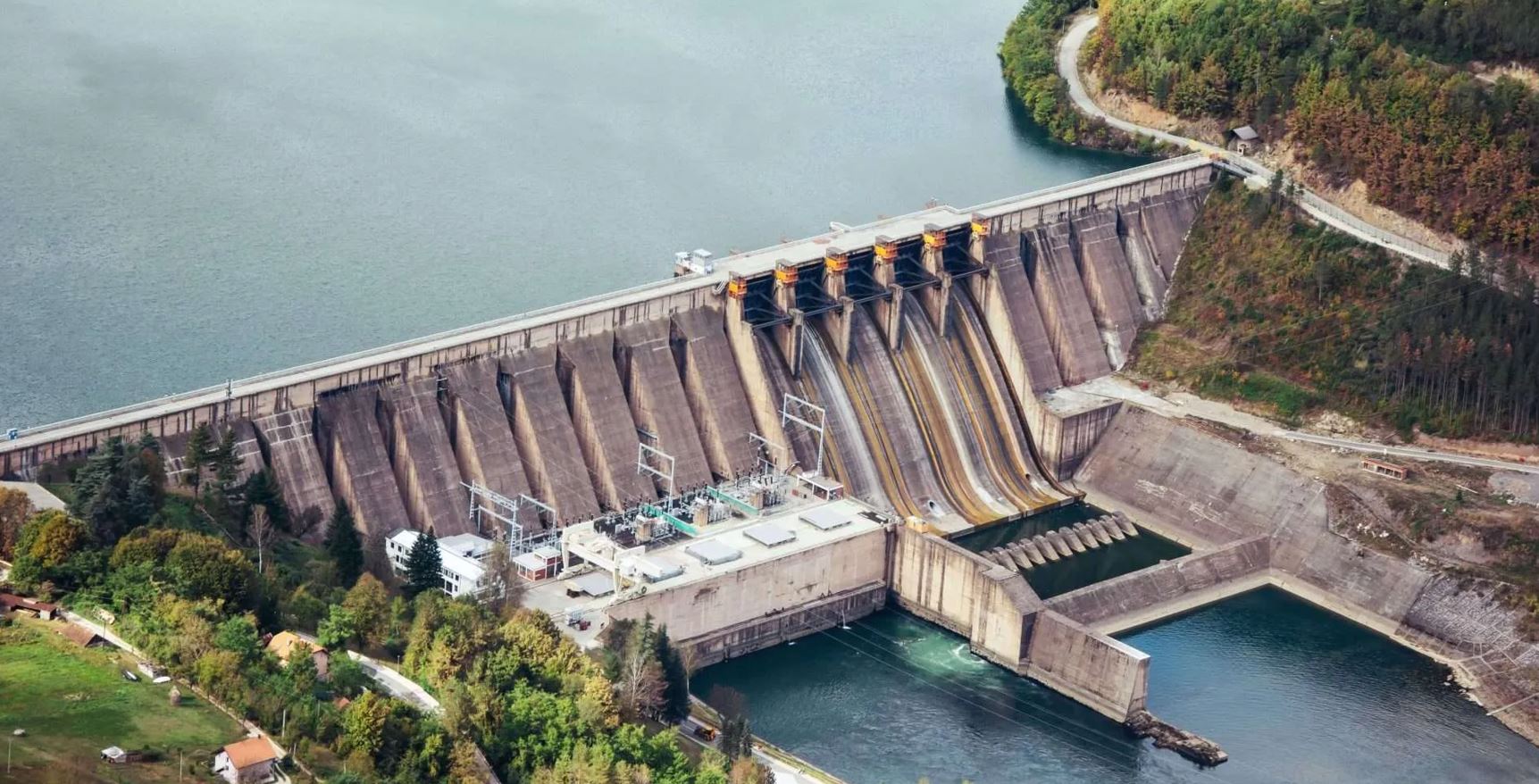

The long-term capital raised through these funds is deployed in infrastructure development, capital markets, government bonds and various investment instruments and is outside the clear and integrated regulatory framework that manages large financial burdens.

Although Nepal Rastra Bank is the regulator of banks and financial institutions, the non-banking social security fund is not directly regulated by the Nepal Rastra Bank. On the other hand, institutional weaknesses in the regulation, monitoring and risk management of these funds, which are being operated under the Ministry of Finance, seem to be increasing. In this context, the Five-Year Financial Sector Development Strategy has proposed to develop a separate regulatory mechanism for non-banking financial institutions.

The strategy aims at building an integrated system for the management of financial obligations related to social protection of civil and civil servants, with a focus on sustainable and inclusive economic development.

The strategy includes investing savings in more productive sectors, carrying out feasibility study for building an integrated system of social security and carrying out legal reforms to operate contribution-based social security schemes.

At present, duplication, increase in administrative expenses and complexities in service delivery are seen when the social security programme is run by various funds. To end this, a plan has been put forward to operate the contribution-based social security scheme through an integrated system.

The strategy has given special priority to expanding the scope of social security programs. The study will be carried out to include the government, public, private and unorganized sector workers, self-employed people and Nepalis in foreign employment in the social security system.

Access to payment gateway (a secure service that accepts online payments on e-commerce websites or apps) system will be made to regularize the contribution of workers and self-employed people in overseas employment. It is expected to develop social security as a broader civil rights rather than a privilege for a limited class.

Investment diversification of non-banking financial funds is another important reform in the strategy. Legal and policy provisions will be made to invest the savings collected in the fund in short-term and long-term financial instruments as per the demand of the market.

Arrangements to allow the fund to invest in areas such as specialised investment fund and private equity fund, expansion of investment in projects related to basic needs including housing for citizens participating in social security programs and development of housing projects with the participation of the funds are expected to make long-term capital mobilization more effective.

Similarly, the strategy aims to diversify investments through closed-ended mutual funds, portfolio management services, among others, to contribute to capital market development. Financial literacy and awareness programmes will be conducted by incorporating the need, rationale, importance and duties of the citizens of the social security programme.

Likewise, the strategy of developing an institutional mechanism for the regulation and monitoring of non-banking financial institutions, making provisions on conduct to protect the interests of the participants, clearly mentioning the potential risks, facility claim process and grievance hearing system in the agreement seems to have made customer protection a policy priority.

The strategy proposes amending related acts to clarify the role, scope and responsibilities of the existing fund, and integrating duplicate programs. It also aims to provide all services from a single portal through the use of modern information technology and integrate insurance, pension and loan investment services.

The most sensitive aspect of the non-banking financial sector is corporate governance and risk management. The strategy aims to implement a holistic risk management framework that identify, assess, and mitigate financial, mobilization, market and social security risks. Likewise, the internal control system will be strengthened and the details of the fund’s financial condition, investment, administrative expenses and other details will be made public regularly.

प्रतिक्रिया दिनुहोस्