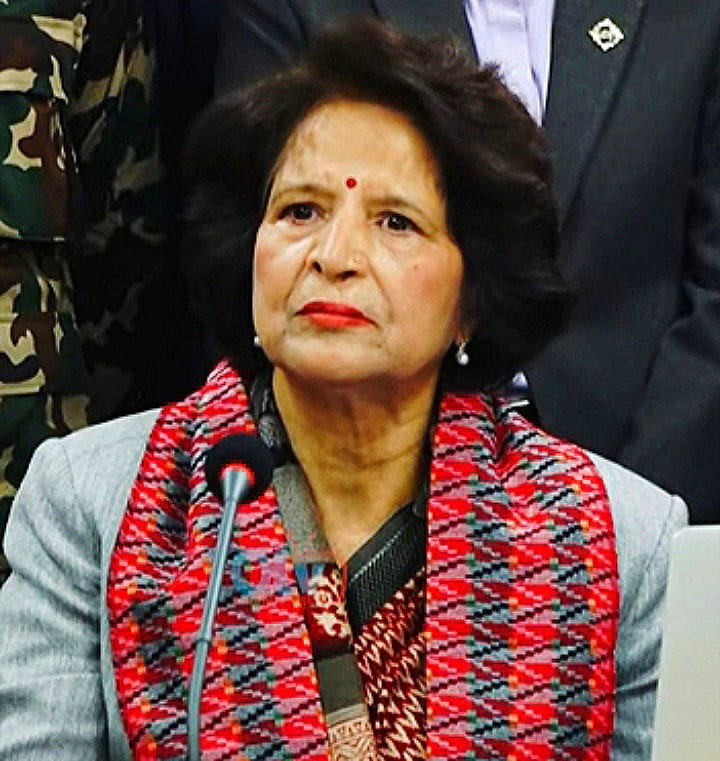

Kathmandu. Dil Maya Tamang, who has made the belief that the future should be secured by insurance, not destiny, has become the name of a quiet yet influential campaign of financial literacy in Nepali society. For many, insurance still seems like a complicated process, high premiums, and a limited issue for the affluent class. But by dispelling this illusion, she is continuously engaged in the campaign to bring the real meaning and importance of insurance to every level, class and community of the society.

For him, insurance is not just a financial product, it is a matter of awareness. Her experience and understanding of how an accident, disease or untimely death can set an entire family back financially by decades has made her dedicated to this field. She clearly says that insurance is not a luxury, not a luxury, it is the basis of life. At the heart of his campaign is the belief that a self-reliant society is not possible without the foundation of economic security.

Dil Maya was born in the Marine bush of Sindhuli district and grew up amidst economic and educational limitations. At that time, education was not as easy as it is today. The distance to school, limited means and family circumstances challenged him repeatedly. But the belief that the boundaries drawn by life could be overcome by the power of consciousness kept him going. Despite the difficulties, she continued her studies and is now in the process of completing her bachelor’s degree.

She entered the insurance sector at a time when the COVID-19 pandemic was plunging the world into uncertainty. It was not only a moment of professional change, but also a turning point in the outlook on life. In the beginning, he didn’t know much about what insurance was and what its benefits were. It was during the lockdown that she first began to understand insurance in her life when she heard about it through a Zoom meeting.

It was during this time that she learned that her parents could be entitled. “If something happens to me tomorrow, my parents will get my insurance money.” From that moment on, insurance was no longer just a paper contract for him, it became a symbol of family responsibility and love. It was this emotional understanding that made him positive towards insurance and taught him to see the field as an instrument of social change.

As she grew older, she accepted insurance as a way of life. Nowhere else has she seen such a mechanism to inculcate the habit of saving, protect against risk, facilitate loans when needed, and help with long-term planning. According to him, insurance makes life easier by binding people with discipline. This understanding led her to the conclusion that she needed to share this knowledge with others, and she became an insurance agent.

For him, to explain to others is not just to explain, but to be an example. “If you want to make others understand the depth of the river, you have to first go into the river and experience it,” she said. The belief that he could win trust only by being insured made him more responsible.

Today, Dil Maya Tamang’s campaign is not limited to the city limits. She has been reaching out to farmers, labourers, housewives, small entrepreneurs, single women, women selling maize on the road and youths going for foreign employment to understand the importance of insurance. With many people running away from insurance saying “no savings”, she says a change of mindset is needed. She continues to spread the message that insurance can be started with a small amount.

His style of explaining is simple and connected with life. If insurance is mandatory when buying a motorcycle, then it is wise to neglect our precious lives without insurance. His goal is not to sell insurance, his goal is to spread awareness.

His work is not just limited to the benefits of insurance. She is open about income management, savings habits, risk management, and long-term planning. She has been presenting insurance as the first step towards self-reliance, believing that people cannot be truly independent unless they are financially independent.

She believes that she should be an example before teaching others. This has further strengthened his commitment and belief. Apart from insurance, she also runs a small business targeting women. The industry, which was started with the aim of preserving the original culture and providing employment to women with children, now employs 10-12 women, which clearly shows their social thinking and human sensitivity.

According to him, the insurance business should be based on honesty and trust. She is adamant that it is wrong to insure without the customer’s income, family situation, and needs. She says that once the trust is broken, this profession will end, so she is very aware of it.

Dil Maya, who got married a few years ago, now has a 16-month-old daughter. After becoming a mother, she has realized the importance of insurance more deeply. She disagrees with the tendency to leave a child’s future to fate, calling it “whatever happens.” His view is clear: One should not be fatalistic in a risk that is easily solved. “Let’s not leave risk to fate, let’s protect it with insurance” has become his philosophy of life.

Looking to the future with her daughter in her arms, she is very proud that she has taken the initiative to protect many families from risk, not only by doing insurance, but also as an insurance campaigner. For him, insurance is not a business, but a continuous journey towards building a self-reliant, safe and aware society.

प्रतिक्रिया दिनुहोस्