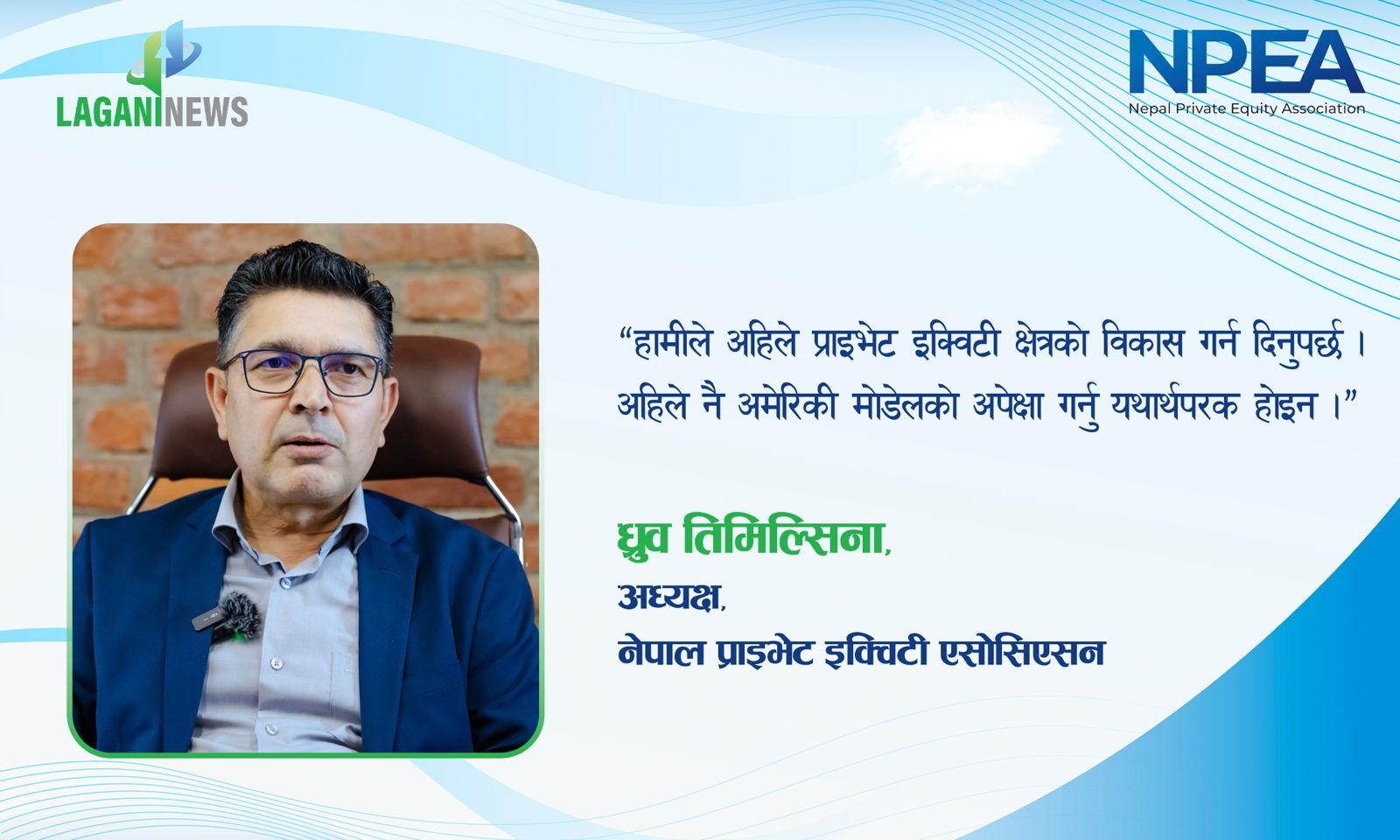

Dhruba Timilsina is currently the President of Nepal Private Equity Association. Timilsina is not only the CHIEF Executive Officer of the Association, but currently in Opportunity Equity. Timilsina has experience of working not only in the private sector but also in regulatory bodies.

Timilsina, who is the CEO of Siddhartha Capital, has also worked in the Securities Board of Nepal. Timilsina, who has experience from regulatory agencies, is now running a private equity association. Lately, the discussion of private equity in Nepal is increasing. How are private equities investing in Nepal now? What role has the association played in attracting not only domestic but also foreign investors?

What are the legal problems? What kind of support has the government provided for investment? A conversation by Sobhit Thapaliya{{TAG_CLOSE_strong_93 TAG_CLOSE_strong_92}} for investmentnews with the association’s president Dhruv Timilsina

What are the challenges in developing the ECOSYSTEM of PEVC in Nepal?

Private equity venture capital is a new concept for Nepal. This system has already been used in the financial markets of other countries. There has also been a problem due to its need and justification and the lack of understanding by the policy makers about it. In general, it is a completely alternative investment fund. It manages traditional ways of investing differently.

Now, when you want to invest, you see a bank for funding an entrepreneur. Those who invest in equity are also made from their own self-capital. The bank invests on the basis of the entrepreneur’s equity. Financial institutions also invest in private equity investments or shares. They are also foreign investment companies and some are registered under the Securities Board.

The job of these companies is to invest in places where they do not have access to banks even when there is a possibility. At present, it seems that PEVC will invest only shares in the market. But that’s not the only thing. What shares or bonds work on is a matter of financial instruments. Nepal Rastra Bank (NRB) has set standards for the loans given by the bank. It also requires collateral. Not everyone can get loans according to that standard. But there is a thought of doing business. Private equity invests in it when they see potential. It has to go into one of the different investment patterns. In private equity venture capital funds, the government has also said that the savings of social security fund, provident fund, citizen investment fund will be invested through private equity fund. Private equity funds are for a while.

The fund is just a bridge vehicle, which aims to generate dividends for investors by managing the money collected from them. The fund manager will only charge a fee for his fund. In theory, the investor’s investment is bridged and all the income earned from that investment is to be given to him.

These funds are tax-induced entities, and the PEVC fund is for a certain period of time. Its income goes to the beneficiaries, the fund manager charges only the service fee. If organizations like the Social Security Fund invest in the fund, the benefits should also go to them. In such a situation, it is unfair to deduct tax on the fund. Because they are tax-inspired entities. The tax rate of all the investors involved is different. Some may have to pay up to 10 per cent, some up to 25 per cent or 39 per cent. Therefore, the tax rate applicable at the time of profit has to be calculated on the basis of .

} How much do you think the regulator understands the issue now?

Nepal Private Equity Association has been making suggestions by organizing various programs. At present, the Securities Board seems to understand some things. They have expressed their commitment to amend the Special Investment Fund Regulations as per international standards. The board also has a good understanding of tax issues. The main challenge now is understanding and collaboration among regulators, investors, and other stakeholders.

What areas of investment are PEVCs focusing more on now?

The members of Private Equity Venture Capital are different. There are also foreign funds. For example, Business Oxygen has invested heavily in small and medium enterprises. Foreign funds such as Dolma have invested in large projects and manufacturing industries. It has been almost two and a half years since the Establishment of Nepal Domicile Fund. Opportunity equity funds are the first, followed by other funds. We are not limited to just one area. We are investing in energy, information technology, tourism, hospitality, agro processing, agriculture, etc. There is no large fund from individual investors in Nepal. Therefore, institutional resources such as employees provident fund, social security fund, citizen investment fund, insurance companies should be included.

We are investors. Entrepreneurs have to go wherever they have invested more. Private equity venture capital will technically support. We help in bringing transparency and networking. At present, the government has given priority to the energy sector. There are also many people in the field of information technology. Tourism and agriculture are also potential areas in Nepal. We have to raise investment. In the case of Nepal, there is no big investment. Big projects also lack equity.

International practices should also be looked into to bring in foreign funds, especially in terms of taxes. If not, it is difficult to bring investment. Now we have said that we can make foreign investment by amending FITA, but that is not enough

We have employees provident fund, citizen investment fund, social security fund. Private pension funds have never been promoted by our state. Those who try to pay dividends to their participants by earning from professional investment management, we do not have that. There is a fund to invest 1.5 percent in the insurance sector, while life insurance companies can invest up to Rs 10 billion. There is an investment of less than Rs 500 million from Non-Life. Which is not much. At present, the Rastra Bank has to pay interest due to more liquidity in the bank.

Rastra Bank has now imposed capital charge on investment. This has put the bank in trouble. There is little possibility of collecting investment internally in Nepal. How to bring in foreign funds is the main issue. International practices should also be seen to bring in foreign funds, especially in terms of taxes. If not, it is difficult to bring investment. Now we have said that we can make foreign investment by amending fit, but that is not enough. SIF regulation itself is not enough. Sebon has started discussions on this.

The Private Equity Venture Capital (PEVC) system in Nepal is still in the early stages. But when we come to the context of it investing by taking loans through banks, there is a policy ambiguity. The Rastra Bank will not be able to bring funds and capital charges will be levied if it is brought. This trend is not correct.

We have to look at international practice. If any investment is high-risk, provisioning should be done, just as loan loss provision is done to handle the risk of debt, it is not appropriate to consider equity investment as risk alone.

Nepal Rastra Bank (NRB) has set a limit of up to 30 percent for banks to invest in shares, debentures and mutual funds. There is also a possibility of some part going to PEVC. This trend should be promoted, not prohibited. In fact, banks have an important role to play in the capital market. The bank is the originator of merchant banking, investment banking, private equity and mutual funds.

Banking and capital markets are not mutually competitive, they are complementary. But why do some policymakers need equity financing after banking financing? It is heard that thinking, which needs to be revised.

Private equity funds invest from money collected from private investors, not public funds. This is not crowdfunding. The bank is responsible for this, but that does not mean that the bank should invest only after taking permission from the public. When the bank gives a loan, takes a mortgage; But when we invest, we deeply evaluate projects and businesses. This is the concept of project finance. There is no interest, there is no collateral, only after the return comes.

we should allow the private equity sector to grow now. Expecting an American model right now is not realistic

We invest more cautiously than banks, because we fully bear the risk until we get returns. The due diligence (DDA) process is followed through ‘third party’ verification before making investment decisions. Legal, financial, compliance with labour acts and technical aspects are examined in it. If there is a risk in DDA, then how to reduce it is analyzed. The investment is made only after all the procedures are completed. The conditions for building the necessary software, MIS reporting system, management mechanism are also included in the investment agreement.

Is it alleged that PEVC invests only for the purpose of earning by selling shares?

Since the PEVC system is new in Nepal, it is natural to see such an understanding, but this is not entirely true. The market is small, the second market is not fully developed yet. In such a situation, the IPO has become the main option of exit. But in many of the SMEs we have invested in, we have taken exits on the basis of cash flow, without selling shares. Bo2 has taken exits in as many as 11 companies, not all of them through the capital market. Even while investing in IT companies, plans have been made in collaboration with the company, not that the capital market is necessary.

The mindset of seeing AN IPO as an alternative to a single exit should be removed. There is nothing wrong if we have taken exits through IPOs. The company got the investment, went to the IPO, then PE sold its shares, it is not appropriate to look at it negatively. Our investment banking sector does not have the capacity to underwrite enough. There is nothing wrong if PEVC helps. We need to develop the private equity sector now. It is not realistic to expect the American model right now.

What is the major challenge facing PEVC right now?

The main challenge is lack of financial awareness. In the past, the capital market wanted to encourage manufacturing companies, there were tax exemptions, but businesses did not come. Now some real sector companies have finally arrived. Now the process of improving the PE fund by investing in such companies, restructuring and taking it to IPO is necessary.

This process is not normal. To build a public company, governance and financial restructuring are necessary. But today’s investors blindfold the risk because it’s their own. Later, they feel that they have invested without looking at the fundamentals themselves. But if PEVC makes a proper valuation and invests, it is good for the market if it lists. It brings good governance companies.

Rastra Bank has now made it easier to withdraw foreign investment. In the insurance sector, up to 1.5 percent PEVC investment has been made. The positive initiatives taken by the government in the last two years are welcome

What initiatives is the Association taking to attract international PEVC to Nepal?

Foreign PEVCs invest in Nepal in two ways, first from their own funds and the other through PEVCM here. Such as the Dolma Fund, which has been investing in Nepal since 2012. They have faced problems due to tax ambiguity while taking the exit. The state should pay attention to removing such policy hurdles. The association is taking initiatives to make the government clear the policy and clearly explain the act and rules.

It is because of our suggestion that the provision of foreign investment has been brought through ‘FITA’. Nepal Rastra Bank (NRB) has made it easier to withdraw foreign investment. In the insurance sector, up to 1.5 percent PEVC investment has been made. The positive initiatives taken by the government in the last two years are welcome.

How do you see the future of PEVC in Nepal?

The main reason for Nepal’s lack of capital is the lack of equity. The most effective way to solve this is private equity venture capital. About 70 percent of foreign investment in India comes through this medium. Such investment does not give ownership of the business to foreigners, but requires returns. The management is done by the fund manager here. If this happens, employment will be created, business will improve.

So far, about Rs 14 billion has been invested from PEVC funds registered in Nepal, in about 80 companies. This amount has been invested in various sectors such as manufacturing, hydro, IT and agriculture. For example, The Opportunity Equity Fund has helped 4,000 farmers in potato production by investing in agro processing in Butwal. Production has increased, market has been found, imports have been replaced. Therefore, PEVC is an indispensable investment tool, it must be promoted. This opens up alternative avenues of development.

How much have PEVCs invested so far?

Of the 13 fund managers licensed by Sebon, 10 funds are in operation. One fund has also brought a second fund. The remaining two are in the process of bringing additional funds. The total investment raised is about Rs 20 billion, of which about Rs 14 billion has already been invested. This investment is concentrated in 80 companies.

What are the fastest-yielding sectors for PEVC?

Energy, agriculture, tourism, IT, and hospitality sectors are promising. Especially in the IT sector, there is a huge potential for working with the network between Nepal and abroad. But there are legal challenges, which, if resolved, can achieve significant heights in IT.

प्रतिक्रिया दिनुहोस्