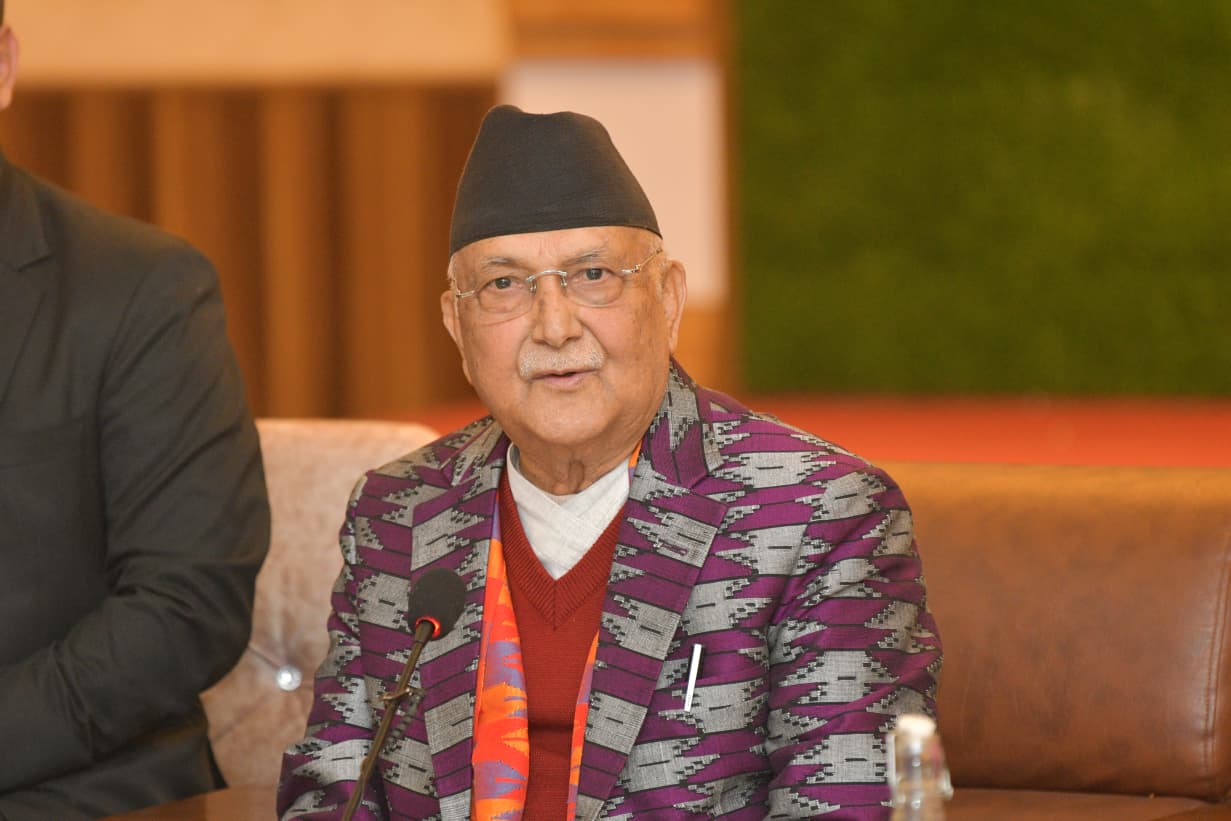

Kathmandu. Prime Minister KP Sharma Oli’s Facebook ID has spread misinformation about the stock market. Oli’s Facebook page has promoted that the stock market has reached 28 points from 21 points in 2081. However, on any trading day of the fiscal year 2081-82, the stock market did not trade below 2200 points.

As K.P. Oli points out, capital gains tax has set a new record in the financial year 2981-82 in favor of capital market reforms. However, Oli did not pay attention to it. A historic record has been set in the capital gains tax received by the state from share trading.

In the last fiscal year 2081-82, the state received Rs 16.54 billion as capital gains tax from the stock market. This is the highest so far. Earlier, in the fiscal year 2077-78 BS, the state had received Capital Gains Tax of Rs 14.06 billion from the stock market. Similarly, in the previous fiscal year, the state had received capital gains tax of Rs 5.50 billion.

According to the CDSC, capital gains tax of Rs 4.23 billion was collected in the last fiscal year. Similarly, it was Rs 2.57 billion in August. Similarly, capital gains tax of Rs 1.04 billion was collected in December, Rs 1.05 billion in January, Rs 1.22 billion in April, Rs 1.17 billion in May and Rs 1.27 billion in June.

According to the CDSC, the profit tax for the months of October, November, December and March is less than billion. According to the CDSC, the state received rs 586.54 million in October, Rs 758.78 million in October, Rs 587.85 million in December and Rs 693.58 million in March.

During this one year, the market has increased by 560.04 points. The market was at 2310.59 points on July 1, 2018. It has now gained 560.04 points to 2,870.63 points. The market has not only increased during this period. The state’s revenue has also increased sharply.

Investors who hold and sell shares from the stock market for a period of one year or less will have to pay 7.5 percent capital gains tax to the state. There is a provision to pay 5 percent profit tax on the profit earned on the shares sold after holding for one year or more. Capital gains tax is affected due to fluctuations in the transaction amount of the stock market. When the market declines, the capital gains tax is raised less and when it increases, it rises more.

प्रतिक्रिया दिनुहोस्