Kathmandu. There are 1,570 branches of commercial banks, development banks and finance companies in Kathmandu, Lalitpur and Bhaktapur. Kathmandu, Lalitpur and Bhaktapur have a total population of 2,994,334. The service provided by each branch will be provided to 1,907 people.

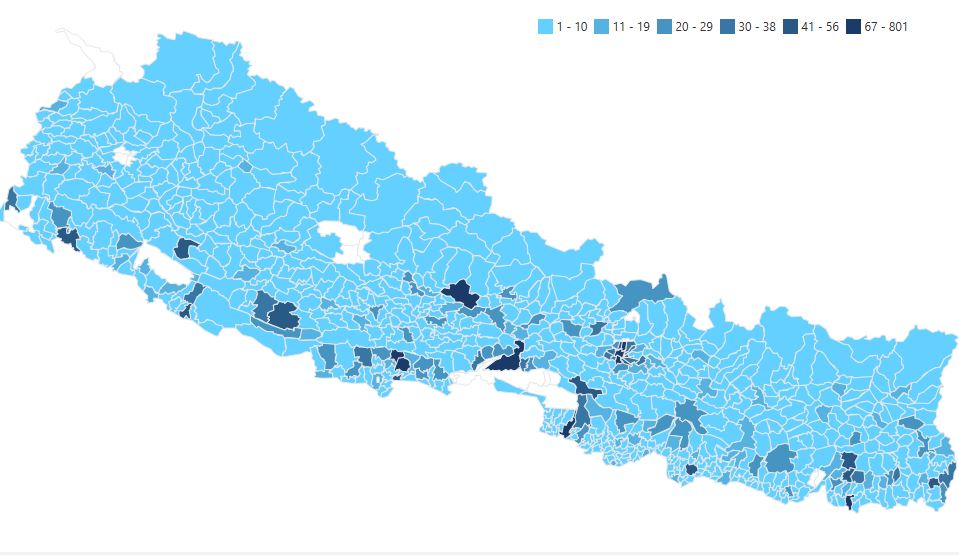

According to the data of Nepal Rastra Bank, Kathmandu district alone has a population of 20,17,115. There are 1,135 branches of banks and financial institutions. The bank provides services to 1,777 people per branch.

Bhaktapur has a population of 425,392. There are 149 branches of banks and financial institutions. The services provided by banks and financial institutions to 2,854 people per branch.

The population of Lalitpur is 551,827. There are 286 branches of banks and financial institutions. Each branch serves 1,929 people.

The total population of Kathmandu Metropolitan City (KMC) is 8,74,276. There are 801 branches of banks and financial institutions. Each branch provides services to 1,091 people on an average.

The area of Kathmandu Valley is 721 square kilometers. The bank has one branch per square kilometer of the bank.

According to Nepal Rastra Bank, the number of mobile banking users has reached 2,82,40,106 as of mid-September 2082. This number was 2,79,88,708 in July. This number has increased in August as compared to July. The number of internet banking users is 22,78,262. It was 22,50,772 in July.

As of August, the number of Connect IPS users is 14,72,030. In July, it was 14,60,804. Similarly, there are 807 branchless banking centers as of August. There were 816 in July. In the last one month, 9 have been closed.

Digital banking has been a major priority in Nepal for the past few years. Since the time of Maha Prasad Adhikari, the outgoing governor of Nepal Rastra Bank, Delittle was given more priority. It has now reached the grocery store through banks and financial numbers.

In the last few years, digital transactions have been increasing more than cash transactions in Nepal. With the increase in digital transactions, will the branches opened by banks and financial institutions, especially in urban areas, be reduced at a distance of 0.900 per square kilometer? Discussions have started in the banks and financial circles whether to reduce the size of big branches.

The branches of the banks, which were once mushroom in the valley, are now neither open nor closed. Some banks have started informal discussions with the Nepal Rastra Bank (NRB) regarding the closure of branches.

Bankers say that with the increase in digital transactions in recent times, some banks are able to meet the expenses of the branch.

Earlier, there is not much crowd in the bank branches which used to be crowded throughout the day. A banker said that even though all transactions are digital, service recipients have started saving time coming to the bank.

“If digital transactions had not increased, there would not have been any problem in the operation of existing branches. Now most of the transactions are digital,” said a banker, “So why do we need so many branches now?” Many banks have come to the question of why the size of the big branches should not be reduced. The branch cannot be closed immediately. Borrowers take loans from that branch. ’

According to the bankers, the NRB has informally conducted a study and discussed with the bankers on which branches should be allowed to close or reduce the size. Currently, the approval of the Nepal Rastra Bank is required to open or close the branch. KATHMANDU: Nepal Rastra Bank (NRB) has formed a task force to recommend banking sector reforms for the purpose of shutting down bank branches.

Dr Bhattarai will present suggestions for the overall improvement and strengthening of the banking sector. The task force formed with Rewat Bahadur Karki as the coordinator, Bhuwan Kumar Dahal as a member and the executive director and member secretary of the Bank and Financial Institutions Regulation Department of Nepal Rastra Bank had recommended the closure of the branches. The task force had suggested making criteria for opening or closing branches and coordinating with the Bankers’ Association so that the criteria do not reach the Nepal Rastra Bank. However, the NRB has not made this report public for about 5 months.

If the Rastra Bank implements this suggestion and the branches of the bank are gradually closed and the big branches are made smaller, then the benefit will reach the profit of the bank. Even if the bank operates a branch with a minimum number of employees, it needs 4 employees. A minimum of 1 branch head, 1 teller, 1 customer care center and 1 operation in-charge are required. This is apart from security personnel and office assistants.

Suppose the bank has a branch in New Road, then on an average you have to pay a monthly rent of Rs 3 lakh. Similarly, there is a branch in Golfutar of Lalitpur and the rent of Rs 50,000 can be reached. The fare depends on the location of the branch. The expenses are also in the same way. The banker said that if this expense can be reduced, it will have an impact on the bank’s profit. At present, the credit flow of the bank has shrunk considerably. The interest on the loan has not been raised. The non-performing loans of the bank are increasing. The operating expenses of the bank have not been reduced. Bankers say that banks should reduce the size of their branches to reduce their operations and its impact on profits. At present, the bank’s deposit collection and loan disbursement is also done digitally.

Former banker Bhuvan Dahal says that it is a good option to reduce the number of branches of the bank due to the increase in digital banking transactions. He believes that with the increase in digital transactions, the number of service recipients at the bank counters is decreasing. “Bankers have been saying that the physical presence of service recipients is decreasing in most of the banks these days,” he said, adding, “The expenses of the banks with branches in the valley have not decreased.” The number of customers is decreasing. In this case, most of the bankers are seen reducing the base of the branch. According to Dahal, this will reduce the expenses of the branch and its impact will be seen on the profit.

Similarly, in Dahal’s book ‘Retirement at Fifty’, he says, “Seeing other banks expanding their branches, my colleagues at Sanima Bank started pressuring me to expand the branches at a faster pace. At the same time, some of the operators continued to worry that we would fall behind. However, I always used to tell them that we already have a presence in major places in the country. They were not satisfied with my answer, saying that a new branch should be opened. I was giving great returns to the shareholders and employees.

In recent years, competition has intensified, competition has increased even in small towns, operating expenses have increased and income other than interest has decreased. Therefore, our strategy cannot be rigid. The presence of more branches in a region than the business potential creates unhealthy competition. Reduces the profitability of existing branches. But when the business potential is enough, then we have to get in, because Sanima has the expertise to compete with the established banks.

Excessive branch expansion also increases operational risk, as it forces employees to compromise on quality, monitoring, and so on. We had to open a branch for social or regulatory reasons. That’s a completely different matter. Regulatory compliance is essential for long-term survival and a good reputation in the market. Our mantra is that we should be a compliance-oriented bank, although there may be costs in the short term. ’

On the other hand, Kiran Pandit, spokesperson of Nepal Rastra Bank, said that there is no problem in increasing the size of the bank’s branches. However, Ali says that attention should be paid to closing the branch. He said that closing the branch should not be done in such a way that financial access is reduced.

He said that it should be seen how many branches of the bank have provided services to how many people in what time. Pandit said that there will be no problem in reducing the size of the branch. He said that even if there is a standard in this regard, financial access should not be left out.

According to NRB sources, discussions are underway whether the two banks can open a branch together.

Meanwhile, the Nepal Rastra Bank (NRB), in its Monetary Policy for the current fiscal year, has stated that the existing branch expansion policy of banks and financial institutions will be reviewed in the context of the strengthening of the e-payment system. It is said that a study is being done on this subject.

प्रतिक्रिया दिनुहोस्