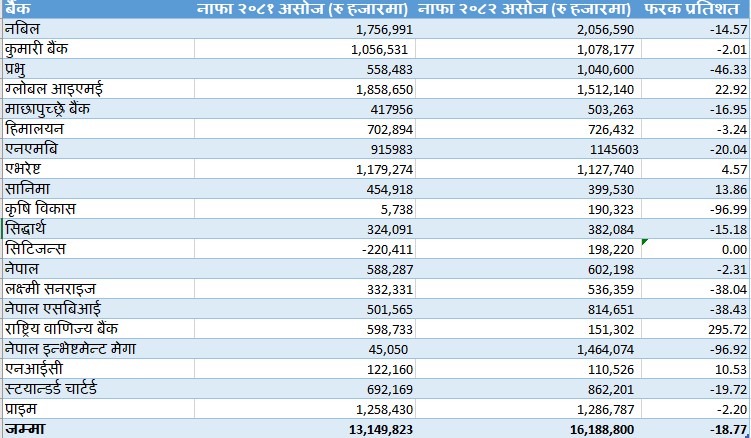

The bank’s net profit declined to Rs 13.14 billion from Rs TAG_OPEN_div_23 16.18 billion in the first quarter of the last FY. Bankers say that in the last few years, the profitability of banks has fallen due to some developments, including the problems in the economy. Along with the economic slowdown, the Genji agitation in August has added to the problems in the business sector.

Commercial banks earn 13.25 billion net profit: 18.77 percent decline, what is the reason for the decline?

Due to various incidents in the country, it is difficult to recover the loan of the bank.TAG_OPEN_div_19 As a result, bad loans are on the rise. The amount of provision required by banks to manage bad loans has also increased. The impact of this has been seen on profits.

प्रतिक्रिया दिनुहोस्