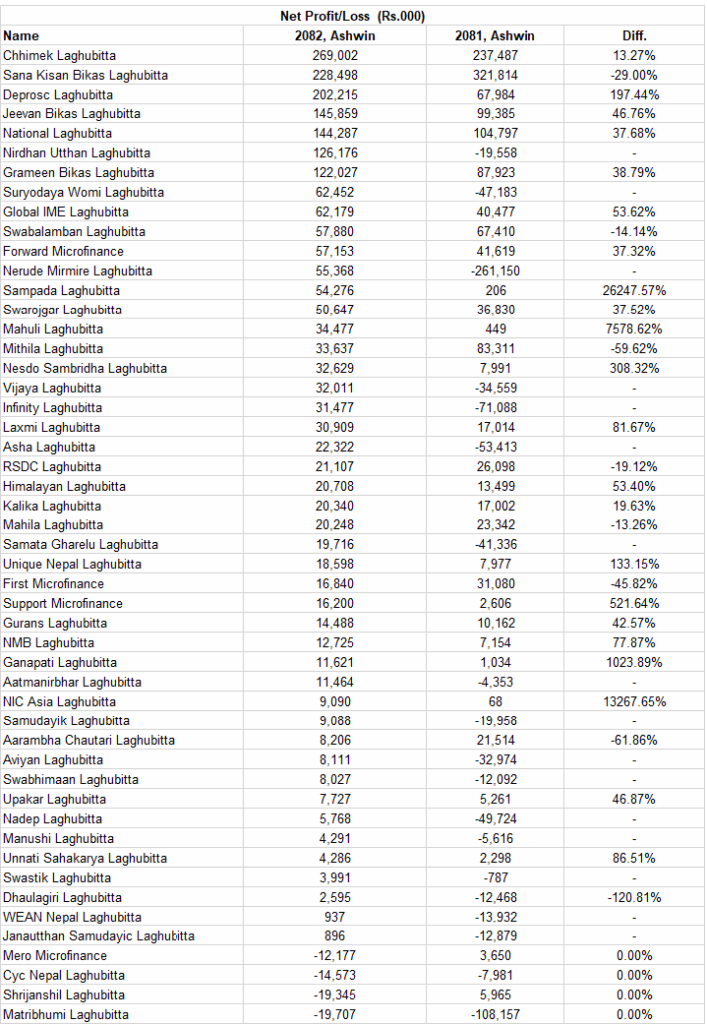

According to the first quarter financial details of the current fiscal year, 50 microfinance companies have earned a profit of Rs 2.TAG_OPEN_div_35 06 billion. The profit of microfinance companies has improved significantly compared to the last fiscal year.

Microfinance’s profit increased by about one and a half billion, how much?

In the last fiscal year, 50 companies had made a profit of Rs 58.41 crore.TAG_OPEN_div_33 Out of 50 microfinance companies, the profit of 22 microfinance companies increased compared to the previous year. Similarly, 17 microfinance institutions that were making losses in the last fiscal year have made a profit.

प्रतिक्रिया दिनुहोस्