Kathmandu. Various groups, including the ‘Pre-IPO’ promoter group, IPO Group A, are being duped by forming groups on social media.

However, there is no law in any state body to take action against such groups. As a result, the cheating group has been punished. If you use WhatsApp on social media, then there are different groups including pre-IPO promoter group, IPO promoter group A, etc. for fraud.

Such groups have evaded taxes on the state and turned black money into white. I don’t know when the company will go public. Since now, there has been a huge fraud in the name of pre-IPO.

It’s not happening now. This business, which has been flourishing for a few years, is now flourishing. Such groups not only create groups on social media but also cheat by calling.

A few days ago, a similar group was informed about the list of companies we had notified to invest in. These included holding companies, investment companies, agricultural companies, helicopter companies, hydropower companies and cement companies. The cement company is currently in the pipeline of the Securities Board.

The pre-IPO of this company was raised so that the IPO would come to the market before Dashain. It hasn’t come yet. Shares of such companies are traded at a price of Rs 125 or more. Shares of some manufacturing companies are also being sold up to Rs 400.

Strong companies, with a net worth of more than Rs 100, are going to issue IPOs in a short time, they are promoting it as a company that pays a lot of dividends. Such fraudsters have been saying that promoter shares will automatically be converted into public shares after three years of investing in shares in pre-IPO.

With the growth of the company while investing in shares, there is a possibility of a sharp increase in the share price in the future, which can give high returns to investors.

Similarly, the company can issue right shares and give shareholders the opportunity to buy more shares at a discount. Gullible investors are trapped. Most of the investors who invest in the name of pre-IPO do not know when the company will issue the IPO, who are the founder shares of the company.

In this way, the Securities Board has also removed some companies who raised money in the market in the name of pre-IPO from the list of IPO pipelines. Those investing in pre-IPOs have made black money a means of turning it into white. The state has also lost the tax it gets from paying a higher price in the name of pre-IP O. All state agencies know that premium price transactions are taking place in the market. Even the relatives of some high-ranking people have been cheated by this.

However, they have cheated that they have to invest now to earn money. There is no law in any state body to take action against such groups. This has made it easier to raise money at a premium price in the name of pre-IPO.

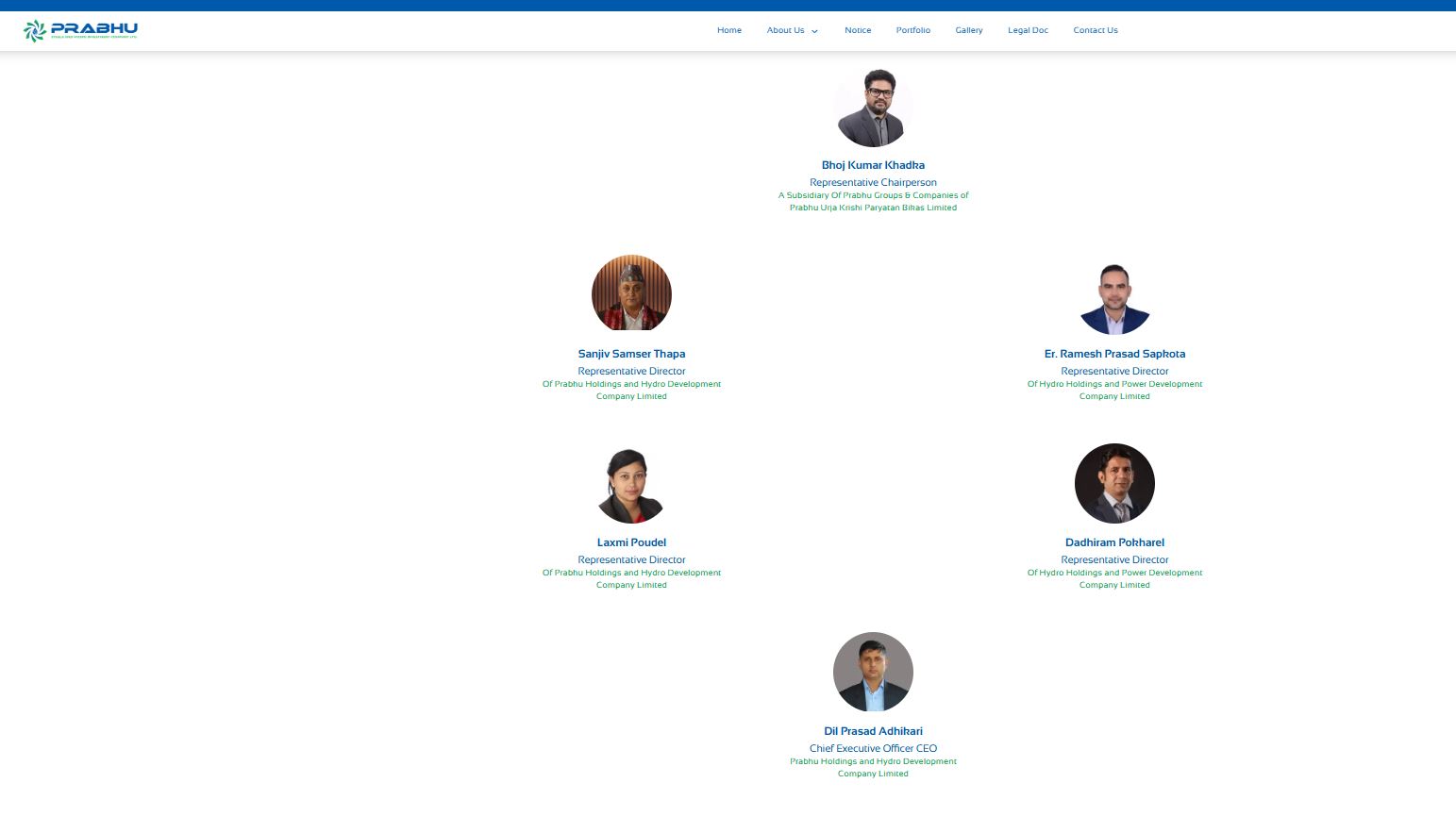

Prabhu Group

The Prabhu Group has been in the news for quite some time now. Some investors have even bowed down when they say ‘Prabhu Group’. Based in Tinkune of Kathmandu, the group is raising investment in agriculture, tourism, hydropower and manufacturing sectors. Various companies under this group had issued a notice on August 1, 2081, stating that they would hold the annual general meeting.

At that time, Prabhu Holdings and Hydro Development Company had issued a notice stating that the meeting would be held at 4 pm on October 1, 2081. On the same day, Hydro Holdings and Power Development Company had convened a meeting at 5 pm on October 14.

Prabhu Urja Agriculture Tourism Development Limited had convened the meeting at 3:00 pm. Prabhu Kewalkar and Tourism Limited had convened the meeting at 5:30 pm on the same date. Similarly, Prabhu Steels and Hydro Equipment Industries Limited had also convened the meeting at 4:45 pm. Everyone had called the meeting at the company’s office in Tinukne.

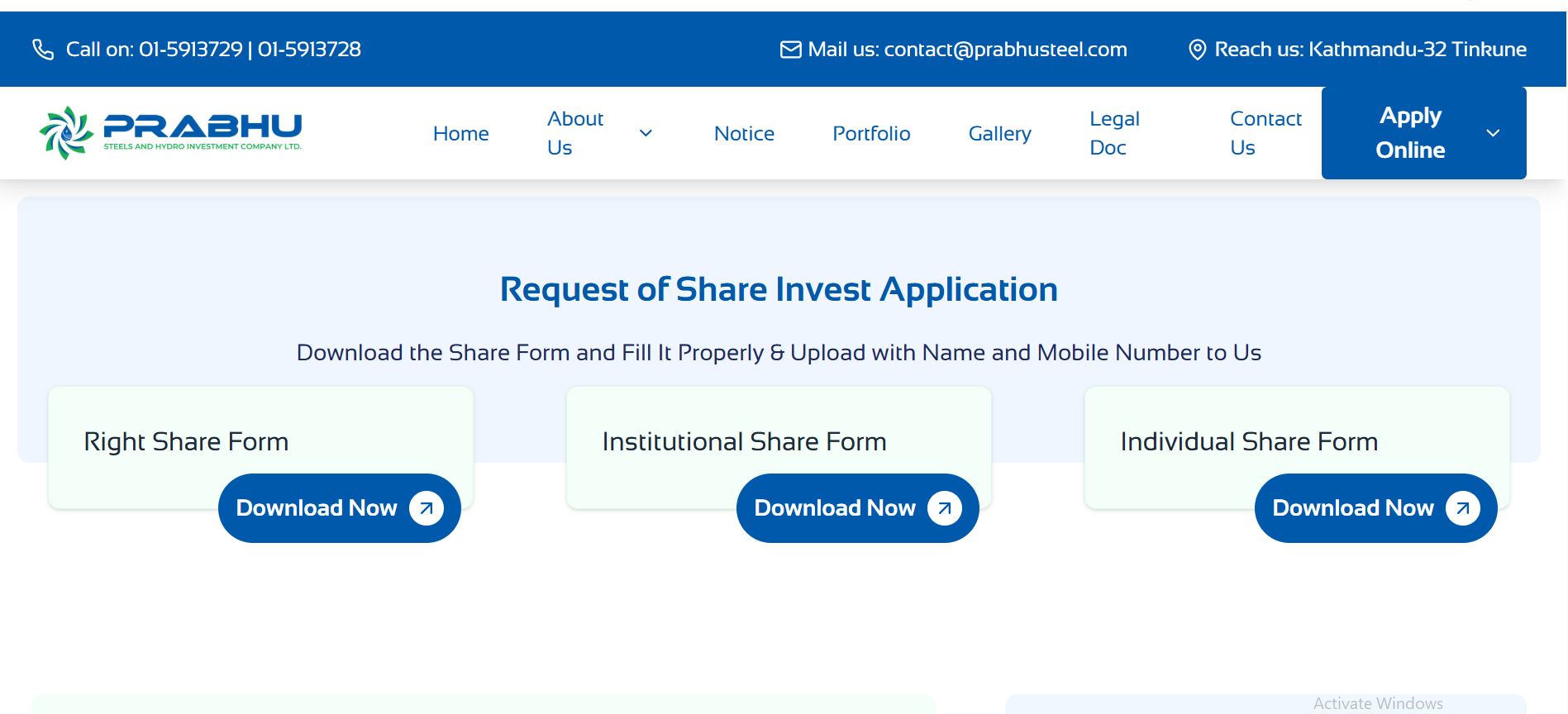

There are about half a dozen companies under this group. Some of the companies of this group had raised pre-IPO up to Rs 130 per share. Prabhu Steels and Hydro Investment Company, part of this group, had also issued a notice to issue right shares at the rate of Rs 50 per share.

RKHI Holdings, a well-known company in the name of pre-IPO, has called its annual general meeting for June 15 to issue an IPO.

Earlier, Unity had also been collecting money by giving different titles. Will the companies that have taken shares in the name of PRIPO now also be unity in the future? That’s the question of many investors. Some investors say that such companies should not be allowed to issue IPOs.

प्रतिक्रिया दिनुहोस्