It has been almost nine months TAG_OPEN_em_89 since Sagar Dhakal took over as the president of Nepal Stock Brokers Association of Nepal. Dhakal became the president after the merger of the two associations. He had presented 23 different schemes while he was preparing for the election to the post of chairman. He had a plan to develop not only brokers, investors but also the entire market. He argued that some of the schemes brought by him at that time have been completed and some are under implementation.

Margin landing, which has been in the news for a long time, is yet to be implemented. Settlement Guarantee Fund is not discussed today. New investors are coming to the market day by day, nothing has been added to the new product. In this situation, what is the Association doing for the development of the overall market? What are the future plans for the development and expansion of the market?

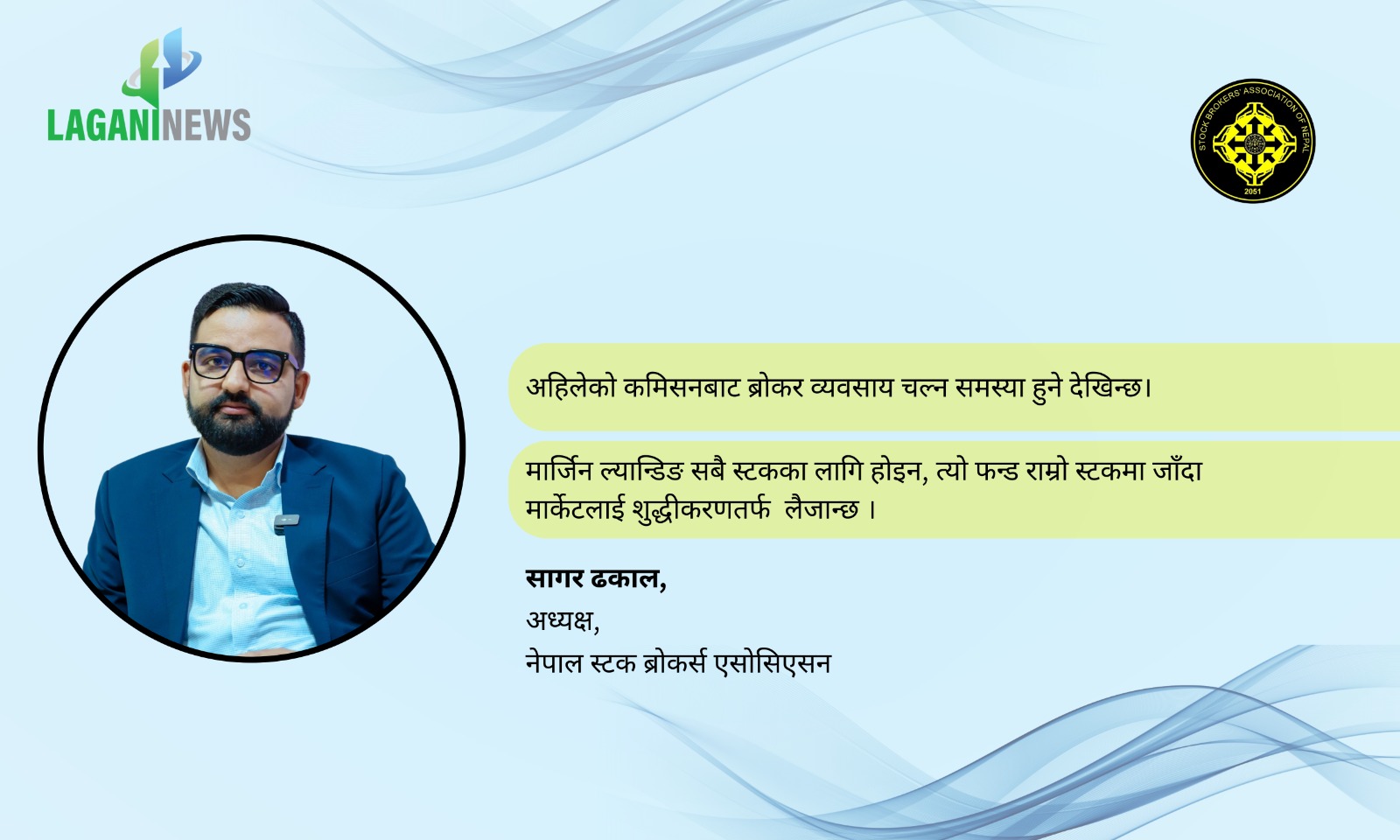

What can be done to provide the broker’s service easily to the common investor? A conversation with The Association’s President Sagar Dhakal} for Investment News by Sobhit Thapaliya}:

It has been almost 9 months since you became president of Nepal Stock Brokers Association, how much work has been done during this period?

There were two associations before I became president. Later, a new working committee was formed under my leadership through the election by merging the two into one another. At the time of the election, we had raised the policy issues under the jurisdiction of NEPSE and SEBON and the jurisdiction of parliament. We specifically raised issues within the jurisdiction of NAPS, such as settlement guarantee fund. We made amendment of some procedures and regulations the main subject regarding the jurisdiction of the Securities Board. Now that’s done. Apart from this, the Securities Entrepreneurs Act is stuck in the Finance Committee of the House of Representatives. We have also given some suggestions in this regard. The rules have been amended as per the issues raised by us.

The main problem now is that the settlement guarantee is in the fund, what is the real?

The settlement guarantee fund has been created with the contribution of broker businessmen, NEPSE and CDS. In some cases, brokers have problems in settlement. At that time, the fund was used and settlement was made to facilitate. It is also being practiced abroad. It is operated under the CDSC. We have a settlement fund of more than Rs 10 crore. There is a problem with the procedure regarding its implementation.

The matter was discussed several times but it did not go unnoticed. Then we came to the conclusion that we cannot operate it from the current procedure. This procedure should be changed. On behalf of the association, we have formed a committee under the leadership of vice-president. Now we are consulting on what can be done legally. Discussions are underway with NEPSE and CDSC in this regard. If nepse sends it to the securities board and approves it from there, the implementation of the fund will proceed.

Sebon has given the broker nine months to add capital, will everyone complete it on time or need other options?

We had also raised this issue during the union elections. In the context of developing and expanding nepal’s capital market, there are old broker businessmen friends. The time has come for them to raise capital. In the past, the capital of banks, insurance authority and Nepal Rastra Bank has also increased. Broker businessmen should also be given that time.

At present, the Securities Board has amended the regulations and extended the capital by nine months. With this, more than 80 percent of the broker business friends easily get capital. If you don’t, some friends feel that they will go with a merger or right offer. If you do not do it at that time, then the second phase of discussion will be held later. It’s over now. You can capitalize on the profits of mid-June.

42 brokers were added to extend the capital market service to the villages. Most of these brokers could not get out of the ring road. The new broker has started selling share ownership less than two years after getting the license. Are brokers unable to run now?

There are three models to diversify capital market services in different parts of the country. The first is to add a new broker to that place, second, to expand the branch network and the third is to expand the online. Digitization reduces the cost to the broker. At present, there is a theme of expanding the branch network to different places. But doing so increases the cost. It is not easy for brokers to expand branches now. If you go digitally, you can easily reach everywhere. Its service should be expanded through online medium.

Now, the broker businessmen who have raised the issue of buying and selling the shares of the broker company, yesterday the percentage that the broker gets when trading shares was high. At that time, the broker’s equity was low. Today, equity is needed at Rs 200 million, Rs 600 million and Rs 15 million. Investors will definitely look for returns. Some brokers now understand that the business has not received the return of investment.

Now it is natural for some old brokers to switch from this business to another business and some new friends are interested in this business. Now the policy of merger has been passed. Many friends can now go down that path and form a large structure organization.

The commission that the broker currently receives. Is that commission reducing the chances of brokers running?

There is only one product in our market right now. That’s just buying/selling equity. In the absence of other products, the income of broker business friends has been limited to just one. It has less income. There seems to be a problem for the broker to run. Now with the amendment of the rules, the broker business has been associated with the issue of providing services to friends. There is now a matter of margin landing. This is a matter related to common broker friends. It adds a business. We have also kept the issue of portfolio in the amendment of the rules. It also makes it a little easier. Dealers worth Rs 150 crore have different types of products.

Other products should be brought by NAPS. Broker business is not just about friends. If NEPSE brings such products, then the matter of commission will also be secondary in giving those products. But in the current context, what a broker earns is only the commission set by the same state. It seems that it is not sustainable. If you look at it here, when the market is at a high point, it seems that some people have earned, but when the market is declining, it is not sustainable. The alternative is to add a product instead of increasing its cost, but to solve the problem in the long run.

Margin lending service is starting, how ready are brokers in it?

Earlier, we were vague in terms of policy. We have amended the regulations so that the service can be extended from all the 92 brokers by amending the rules. At the same time, a procedure should be made. There is an old procedure. At present, a committee has been formed under the coordination of Rupesh KC for the working procedure in Sebon. The committee is doing its homework. We have also sent various suggestions on behalf of the association. Perhaps in a week or two, that procedure will also come. At the same time, there are things about where to get the fund. Rastra Bank also plays an important role in this.

We have also met the governor of the country and told him. At present, the only demand of broker businessmen is that the margin landing product should be implemented. There are more than 6.5 million demat holders. You have to be an investor. They should proceed with the margin work through the broker. If that happens, the problems seen in the broker, the problems of lending transactions will be solved. After the implementation of the margin landing, the transaction will be done in cash or in the margin. That’s why we want to take this product forward. Maybe in a week or two, the procedure will be ready and I think it can be taken forward.

How does a broker benefit investors when he starts margin trading?

Even after the broker starts margin trading, the main source is the bank. The bank trusts the broker and invests. It is managed by a broker company. Investors get all the services from the broker while trading. There is no problem of investors going to the bank to buy shares, going to the broker, stopping, releasing them. Everything comes from one place. Ordinary investors can easily use a lot. This increases the size of the market.

Investors don’t have fund problems. Margin landings are not for all stocks. They buy good stocks. When that fund goes into good stock, it also purifies the market.

Interest rates are a little more expensive in a broker than in a bank like you are trying to eject. That’s for managing funds. Interest is definitely more expensive than in a bank. But investors get one-door service. The obligation to go to the bank and deal is removed.

TAG_OPEN_strong_77 When will non-resident Nepalis enter the Nepali stock market as investors, how is the association working on it?

We have been raising this issue for a long time. Not only non-resident Nepalis, but others should also be brought into nepal’s capital market and the size of institutional investors should be increased. On the question of whether this issue will come in the budget, the policies and programs of the Securities Board but will not be implemented, it seems that this time all the bodies have become more clear on this issue. From this time onwards, I think the NRNA will be able to do business. This issue is in the budget, in the policy program. There is no problem with that. I don’t think buying and selling shares should be stopped. It seems that after the state has brought the policy program in the budget, it will now go to the implementation stage.

Says that the risk in share trading has increased due to the provision of allowing only two demat accounts to be opened at present, how has that risk increased?

In this, we have said technically that the Securities Board has formed a committee regarding demat and it has also given its report. In the report given by that committee, it has been said that more than two should be implemented. When the directive came in this regard, the board has come up with a direct instruction that the same person filled many IPOs and misused them. It is a matter related to the broker in which you open a TMS account at present. It is also a matter of security for the broker.

You buy shares in cash or margins, but if you take their shares to some other place, there is a problem in terms of the safety of the broker businessman. The securities board has already passed the report. Send it to CDSC. They should have a single ID with their national ID, do not make it expensive in terms of cost, and should be visible in the same ID no matter how many. Many brokers should also be able to open. Preparations are underway. This problem will be resolved soon.

Has there been any initiative to provide financial penalty to the company instead of suspending the transaction as suspending the transaction will hurt the investors associated with the broker while suspending the transaction to the securities broker who do not implement the law brought by the Securities Board?

There is a very wrong process in this. We do financial transactions. Financial penalties should be imposed on financial transactions. In the context of the settlement of the businessman, sometimes when the settlement is broken, the business will not be allowed to do business for three days and millions of investors associated with the business will be affected by it. This is not fair to investors. It is for investors to look at the regulator’s decision.

This should be changed for the benefit of investors. We have been raising this issue from the very beginning. Sebon is also studying it. We will move forward through the process of discussion. For example, the association demands that the shareholders of the broker should be allowed to trade shares from their own brokers.

According to TAG_OPEN_strong_74 the association, it will take initiative to buy and sell shares from their own institutions to the shareholders of the securities broker business companies operating in operation. How legitimate is this issue? What’s going on with it?

We had taken this issue forward during the amendment of the rules. Some brokers have suggested that there will be some conflict in this. That’s why we have removed it now. It is not included in the amendment of the rules. However, if you look at the practice around the world, we have kept that it is easier for the regulatory body to track when reporting by trading in the same broker rather than going to the remaining 92 brokers and tracking its record.

How do you analyze the stock market in the current situation?

We need to look at it in two ways: primary and secondary market. In the primary market, we had to face a long hassle, sit in a line and fill the IPO. By developing this trend, today we have reached the level of filling the IPO in one click. But in the secondary market, you had to fill the order firm for buying and selling shares. The same thing has become easier today due to technology. However, no product has been added. For this reason, the growth and expansion of the capital market has been very slow.

प्रतिक्रिया दिनुहोस्