Kathmandu. The demand for credit in the banking sector has been sluggish for a long time. When there is no demand for loans, there is enough liquidity to invest. There has been a problem in the mobilization of deposits as the bank has not been able to provide loans. At present, the demand for loans is also at a very low point.

Even when the interest rate of loans is very low, the number of people going to the bank to take loans is very low. The Genji agitation that took place two months ago on September 23 and 24 at a time when industrialists are refusing to take loans even at interest rates, citing lack of investment environment, has left the private sector in extreme despair. The private sector, which has been a victim of unstable politics, has become more frustrated by the Genji movement. The vandalism and arson of the private sector in the name of the Genji movement has further disturbed the investment climate.

The impact of this has also been clearly indicated by the deposits and loans that the banking sector collects. According to the financial situation of the first quarter of the current fiscal year, the deposits collected by the banks have shrunk and the loan flow is also slow.

Deposit growth is also low and credit flow is weak. In particular, the first quarter financial statements of the current fiscal year 2082/83 published by the banks have shown this. The deposit collection and loan flow of the banks seems to be sluggish compared to the end of the last fiscal year.

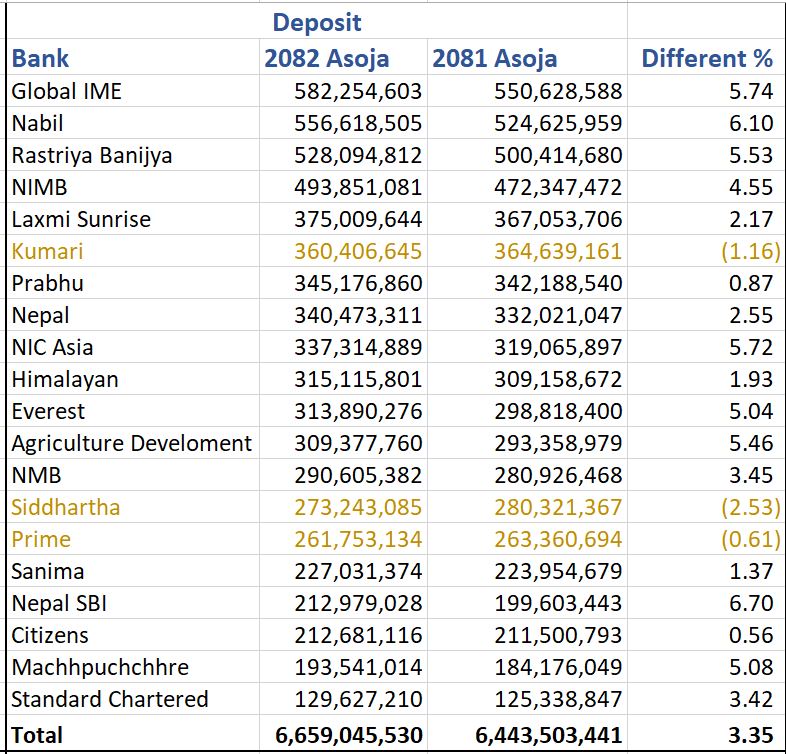

In the first three months of the current fiscal year, 20 commercial banks have collected deposits of Rs 6.659 trillion. This is only 3.35 percent more than the same period last year. In the first quarter of the last FY, the banks had earned Rs 644.50 billion.

Out of 20 banks, the deposits of three banks have decreased while the deposits of the remaining 17 banks have increased. Kumari Bank fell 1.16 percent, Siddhartha Bank 2.53 percent and Prime Bank 0.61 percent. During the review period, the deposit of Nepal SBI Bank increased by 6.70 percent to Rs 212.97 billion. Similarly, Nabil Bank’s deposit increased by 6.10 percent to Rs 556.61 billion.

Global IME Bank’s deposit has increased by 5.74 percent to Rs 582.25 billion, NIC Asia Bank by 5.72 percent to Rs 337.31 billion and Rastriya Banijya Bank by 5.53 percent to Rs 528.09 billion.

Similarly, agriculture development has increased by 5.46 per cent to Rs 309.37 billion, fish pucche has increased by 5.08 per cent to Rs 193.54 billion and Everest has increased by 5.04 per cent to Rs 313.89 billion.

Similarly, deposit of Nepal Investment Mega Bank increased by 4.55 percent to Rs 493.85 billion. Deposits of Laxmi Sunrise Bank increased 2.17 per cent, Prabhu Bank 0.87 per cent, Nepal Bank 2.55 per cent, Himalayan Bank 1.93 per cent, NMB Bank 3.45 per cent, Sanima Bank 1.37 per cent, Citizens Bank 0.56 per cent and Standard Chartered Bank 3.42 per cent.

In the first three months of the current fiscal year, banks have extended loans worth Rs 4738.63 billion. This is 1.62 percent more than the same period last year. In the same period of the last FY, the banks had a total of Rs 463.09 billion.

Loans from banks have slowed down in recent years due to the decline in demand for loans. Out of 20 commercial banks, the loan disbursement from four banks has decreased. Likewise, Himalayan Bank fell 0.05 per cent, Agricultural Development Bank 0.08 per cent, NIC Asia Bank 5.31 per cent and Standard Chartered Bank 3.81 per cent.

Everest Bank is one of the most sought after loans. Everest Bank’s loan has increased by 6.52 percent to Rs 227.34 billion. Likewise, Machhapuchchhre Bank Ltd, Kumari Bank Ltd, Rastriya Banijya Bank Ltd, Nepal SBI Bank Ltd, Global IME Bank Ltd, Global IME Bank Ltd, Laxmi Sunrise Bank Ltd, NMB Bank and Prime Bank Ltd rose 2.14 per cent in the review period. Likewise, Nabil Bank Ltd increased 1.99 per cent, Nepal Investment Mega Bank 1.19 per cent, Prabhu Bank 0.21 per cent, Nepal 0.94 per cent, Siddhartha Bank 1.65 per cent, Sanima 0.63 per cent and Nepal SBI Bank 2.97 per cent. Citizens Bank has remained stable.

प्रतिक्रिया दिनुहोस्