. Nepal Rastra Bank (NRB) Governor Prof. Dr. The bank and financial sector has been terrified by the statement made by Bishwanath Poudel in a public program.

On Sunday, Governor Poudel had said, “Selling someone else’s collateral for one’s benefit is a part of corruption.”TAG_OPEN_p_32 The central bank does not take this as an excuse. ”

The governor’s statement is said to have led to internal tensions in the banking sector.TAG_OPEN_p_31 It is the responsibility of the state to take action against the wrongdoers. There is a legal provision that the bank will keep the collateral while giving the loan, auction the collateral if it is not recovered and if necessary, the bank will accept the collateral.

Bankers believe that this statement made by Governor Poudel against the prevailing laws, rules and regulations can create anarchy in the banking sector and will give a boost to groups like ‘Save the Citizen’ led by medical entrepreneur Durga Prasai.TAG_OPEN_p_30

At present, Prasai Group has been spreading publicity by illegally seizing the collateral auctioned by the bank, encouraging borrowers who have taken loans from various financial institutions not to repay the loan, saying “the interest will be waived” and “the loan should not be repaid”.TAG_OPEN_p_29 Bankers argue that the governor’s statement will boost the morale of such groups.

A banker said that the governor’s public statement that “trying to profit by selling mortgages is corruption” will cause problems in the bank’s operation and will benefit the Prasai group.TAG_OPEN_p_28

} “There is never a policy of auctioning the collateral of the borrower as soon as the bank gives a loan,” the banker said. But if someone does something wrong, action will be taken against him. There is no example of banks not providing relief to borrowers if they are in trouble, otherwise how much land would there be in the name of banks across the country?”

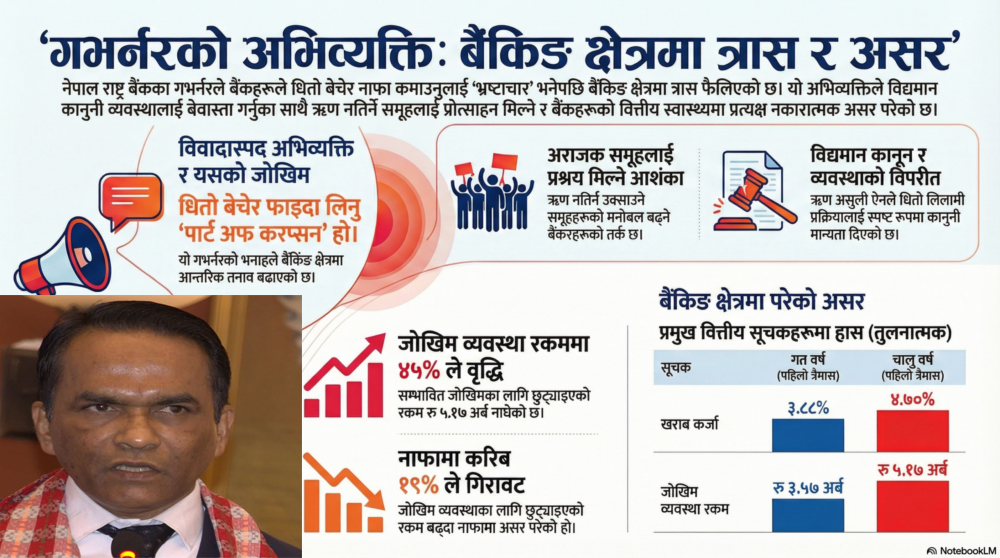

TAG_OPEN_p_25 The number of participants in the auction has also decreased. When the bank is unable to raise the collateral, it has to keep a loan provision and this amount has been increasing in recent times. In the first quarter of the current fiscal year, the amount allocated by banks for risk management has increased by 45.04 percent. In the first quarter of last year, it was Rs 3.57 billion, which increased to Rs 5.17 billion this year. Profit has fallen by about 19 percent due to the increase in provisions.

The bank’s NPL has increased from 3.88 percent last year to 4.7 TAG_OPEN_p_24 0 percent now. Bad loans have increased due to the failure to repay the principal and interest of the loan on time. In such a sensitive situation, the banks are dissatisfied with the governor’s statement that it will affect the banks.

According to the Nepal Rastra Bank Act, 2058 and the Bank and Financial Institutions (BAFIA) Act, 2073, the bank cannot lend without collateral.TAG_OPEN_p_22 The integrated directive issued by the Nepal Rastra Bank from time to time has also reiterated this provision. Similarly, Clause 28 and 29 of the Loan Recovery Regulations of the Bank and Financial Institutions (BFIs) 2059 clearly mentions the loan recovery and auction process. Banks cannot recover arbitrary loans.

If the bank is found to have given loan without collateral, the senior officers and directors of the bank will take responsibility for it.TAG_OPEN_p_20 Because the bank gives the loan from the depositor’s money, if the debt is not repaid, the depositor does not get interest, the shareholder does not get the dividend, the state loses tax revenue. Therefore, the main responsibility of the bank is the security of deposits.

The Act provides that if the loan is not repaid, the collateral will be auctioned and the bank will accept it if necessary.TAG_OPEN_p_19 Similarly, Clause 18 of the Unified Directive on Credit Information and Blacklisting provides for the dissemination of false information, disbursement of loans to those who are blacklisted, or fines and actions against banks that do not recommend them in the blacklist.

Bankers say that the bank officials can be taken action if they do not obey the directive, but the governor has said that such an act is ‘corruption’ for the banking sector.TAG_OPEN_p_18

प्रतिक्रिया दिनुहोस्