Kathmandu. The Securities Board of Nepal (SEBON) has issued an 8-point directive to the companies that are going to issue ordinary shares (IPO).

A new 8-point directive has been issued amending the previous provision. According to the decision of the Board of Directors, the new system will be applicable to the companies that are going to issue IPOs.

As per the new provision, the company must have been in operation for at least the last three years and has made a profit in the first two fiscal years to issue an IPO. The net worth per share of the company should be more than the face value.

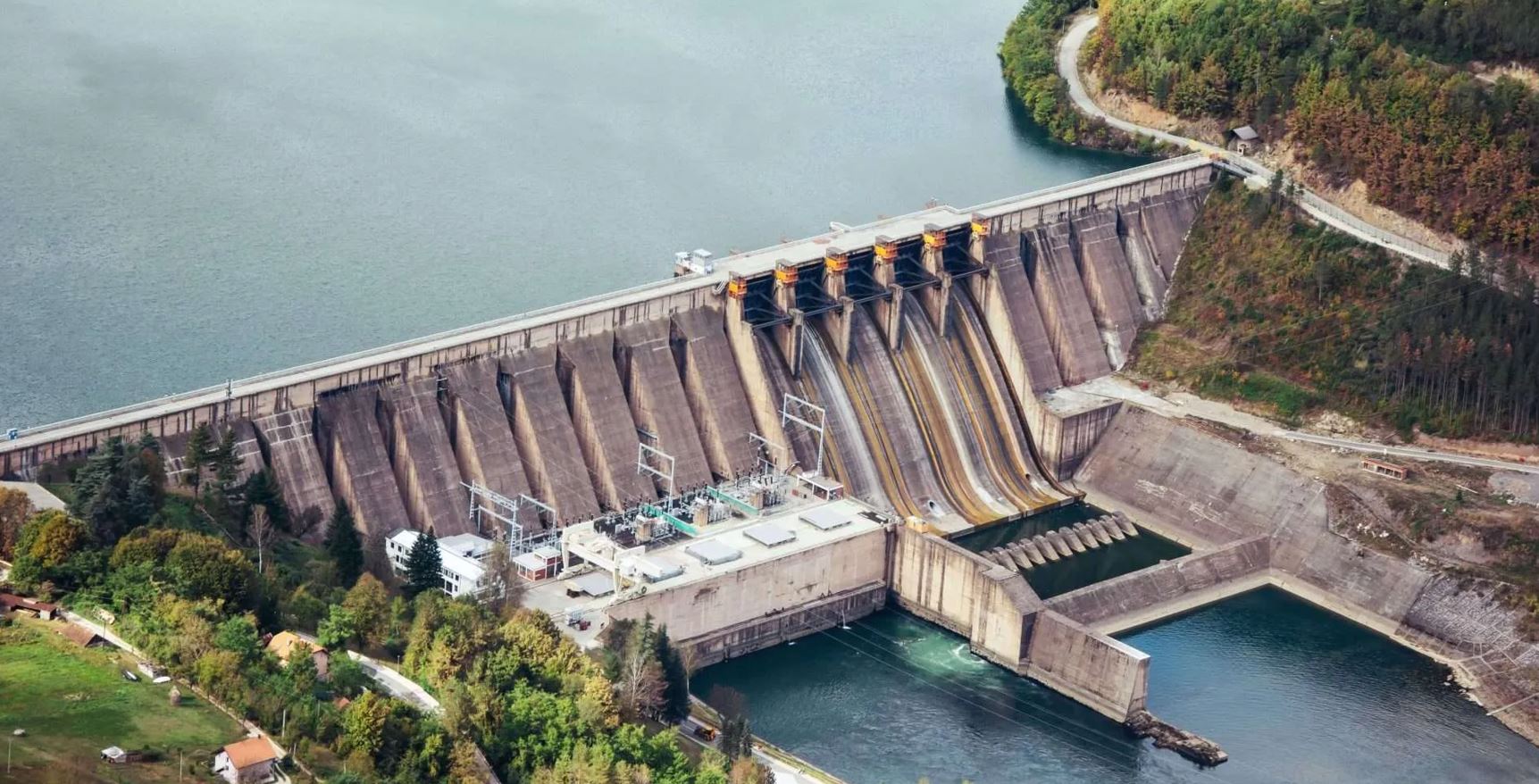

According to the Board, the investment companies are not allowed to buy shares of companies related to energy, transport, communications, agriculture, tourism, production and processing, information technology and mineral extraction through primary and secondary market.

Companies that have been approved as qualified institutional investors by the Board can invest only in IPOs through book building method of corporate institutions of these sectors. As per the revised criteria, the investment company should have a credit rating of at least one level and the paid-up capital should be at least Rs 500 million.

Similarly, entities or investment companies established by the government of Nepal or established with the objective of investing in energy, transport, communication, agriculture, tourism, production and processing, information technology and mineral extraction are also eligible for the IPO.

According to the Board, the corporate institutions established with foreign investment should fulfill the process as per the Foreign Investment and Technology Transfer Act.

प्रतिक्रिया दिनुहोस्