Kathmandu. The Securities Board of Nepal, the regulatory body of the capital market, has been found to be protecting insider trading that is considered to be against the law. The board is silent on the action taken even though its own study has confirmed the insider trading. The board’s silence for the last three years is seen as meaningful.

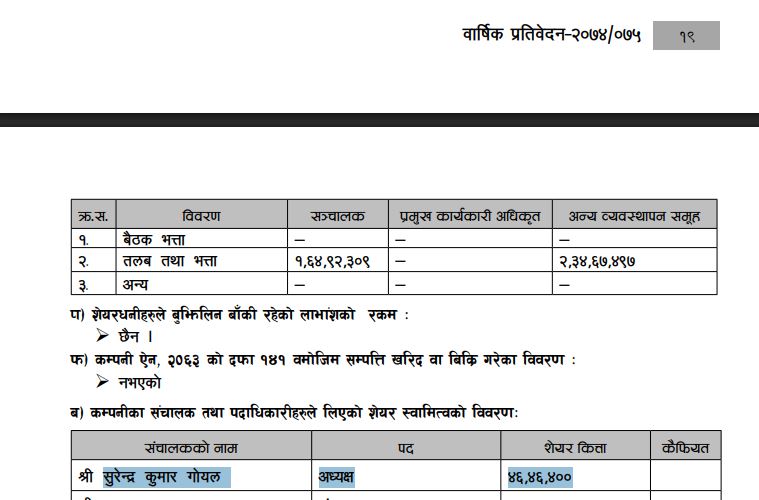

Surendra Kumar Goyal, the then chairman of Shivam Cement, was involved in transactions violating the Securities Act. And the body that protects him is the Securities Board. When Goyal was the chairman, four members of his family had transacted crores of rupees in violation of the Securities Act. This was confirmed by the board’s own study.

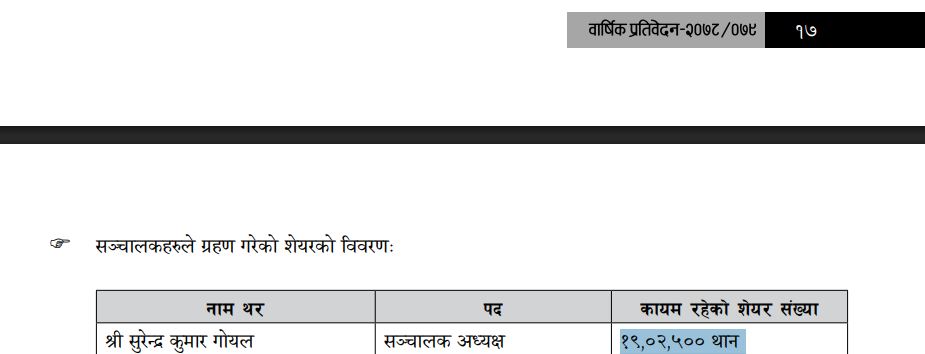

Goyal had sold 27,43,900 units of shares out of 46,46,400 units in the name of his family members in violation of the law. This is contrary to the Securities Board Act. But even after knowing all this, the Securities Board is silent.

On Chaitra 8, 2078 BS, the family of Surendra Kumar Gogal was divided. Surendra had transferred 24,28,900 units of shares to his elder brother Bishwanath Goyal and 3,15,000 units to Anita Goyal.

At the same time, Surendra was the chairman of his elder brother Late Surendra. According to the study, Ashok Kumar Goyal’s wife Anita Goyal was sold 5,640 units of shares at Rs 487 to Rs 494 per share for Rs 2,761,590 on May 12, 2019. She received 5,640 units of shares through primary shares on March 19, 2018.

According to the study, Anita Goyal sold 4,72,995 units of shares at a price of Rs 39,12,44,277 from April 29, 2021 to Rs 1,011 per share.

Similarly, Anita bought 4,000 units of shares at a price of Rs 846 to Rs 851.1 per share at Rs 3,394,2000. During this period, he bought shares at a maximum price of Rs 851 and sold them at a maximum price of Rs 1,011.

The story of the sale of shares does not end here. On April 7, 2021, 19,45,002 units were transferred in the name of Poonam Goyal, wife of Surendra Goyal, in the name of Anita Goyal.

On May 12, 2019, Goel had sold 5,640 units of shares at a price of Rs 450 to Rs 452 per share at a price of Rs 2,543,280. He has said that he received 5,640 units of shares through primary shares on March 19, 2018. He had sold 2,590 units of shares at a price of Rs 1,500 to Rs 1,799 per share for Rs 4,138,320 from June 2, 2021.

Bishwanath had bought 2,590 units of shares at a price of Rs 4,022,575 from February 7, 2020 to Rs 1,640. He bought a maximum of Rs 1,640 and sold shares for Rs 1,799. Similarly, Poonam Goyal, wife of Surendra Kumar Goyal, transferred 23,14,000 units of shares to Prakash Goyal on April 7, 2021.

Prakash Goyal had received 5,640 units of shares through primary shares on March 19, 2018. He had sold the shares at Rs 540 to Rs 544 per share on May 15, 2019. The shares were sold at Rs 30,61,600.

Prakash had sold 3,31,005 units of shares at Rs 588 to Rs 830 per share for Rs 223,143,919.70 from August 2, 2022.

On May 15, 2019, Vishwanath’s wife Shashi Goyal sold 5,640 units of shares at a price of Rs 493 to Rs 495 per share. Bishwanath and his wife Shashi, Anita Goyal and brother Prakash Goyal had sold 829,150 units of shares for Rs 62,96,78,787 between May 29, 2019 to December 1, 2079. Similarly, Bishwanath and Anita Goyal had bought 6,590 units of shares for Rs 7,416,775 between February 22, 2020 to May 22, 2022.

During the period, shares worth Rs 63,70,95,562 were traded. At that time, Surendra Goyal was the executive chairman of the company. Goyal exited the company after the AGM on January 29, 2019 after selling the shares in violation of the law.

A study conducted by Sebon has confirmed that the shares given by Surendra were sold by the family members of the same family. The board had recommended action against Goyal, who was involved in illegal transactions.

“Clause 22 (1) (a) of the Securities Issue and Allotment Directive-2074 states that the shareholders who have received the shares of the corporate company prior to the initial public offering as project affected persons, employees or founders or in any other manner are not allowed to apply for any application.

Not only that, Rule 46 (8) of the Securities Registration and Issue Rules, 2073 BS states that if anyone is found to have made an unauthorized application for the purchase of securities or submitted false details, the issue manager shall cancel such application and forfeit the amount and deposit the amount in the account specified by the Board. The amount so collected should be used only for the development and promotion of the capital market.

Goyal’s business seems to be contrary to these provisions. Even when the concerned branch of SEBON has studied and recommended action against the transaction against the law, the top level employees have remained silent.

If SEBON is found to have violated the provisions of the Securities Registration and Issue Regulations and Securities Issue and Allotment Directives, Sebon can use Rs 1,11,52,270 of the shares acquired by Biswanath, Sashi, Anita and Prakash for the development and promotion of capital markets. According to the study of Sebon, these three people have received 5,640 units of shares. The top officials here do not seem to want to open their mouths on why Sebon is silent on this issue.

In this regard, the transactions of elder brother Bishwanath and sister-in-law Shashi Goyal in the secondary market were contrary to the provisions of Rule 38 (1) (a) of the Securities Registration and Issue Regulations, 2073 BS. At the same time, sister-in-law Anita Goyal has been seen doing business repeatedly. According to the study, it is against the provisions of Rule 38 Sub-rule 1 (a) of the Securities Registration and Issue Regulations-2073.

Not only this, his brother Prakash Goyal had also carried out transactions in violation of the provisions of Rule 38 (1) (a) of the Securities Registration and Issue Regulations, 2073 BS.

According to the study, his wife Poonam Goyal, who is the manager of the company, transferred 19,45,200 units of shares to Anita Goyal and 23,14,000 units to Prakash Goyal. This transaction is against the provisions of Rule 38 Sub-rule 1 (a) of the Securities Registration and Issue Regulations, 2073.

The committee has recommended action against the then chairman Surendra Kumar Goyal, his wife Poonam Goyal, brother Prakash Goyal, brother Bishwanath Goyal and sister-in-law Anita Goyal for trading shares against Rule 38 (1) (a) of the Securities Registration and Issue Regulations, 2073.

Sub-section (7) of the penal punishment clause of Section 101 of the Act states that the Board may impose a fine of Rs 25,000 to Rs 75,000 on any person who violates the rules or bylaws framed under this Act or any order or directive issued thereunder or if he violates the conditions specified by the Board.

On April 7, 2021, Surendra Kumar has handed over 24,28,900 units to Vishwanath, 3,15,000 units to Anita and 70,03,100 units including 19,45,200 units to Anita and 23,14,000 units to Prakash.

Their families have sold 804,000 units of shares worth Rs 614.38 million from April 29, 2021 to December 1, 2079. During the period, 4,000 units of shares worth Rs 3,394,200 were traded.

On April 7, 2021, 25,150 units of shares were sold for Rs 1,52,90,590 and 2,590 units were purchased for Rs 4,022,575. According to a study by Sebon, Surendra’s family members bought and sold shares worth Rs 20 million during his tenure as chairman.

The question has also been raised on the basis of which the CDSC allowed the transfer of the shares. This has also raised questions about the role of the CDSC, said a Sebon employee.

On the other hand, Chairman of the Board Santosh Narayan Shrestha has claimed that all transactions done against the Act of Sebon will be brought under the legal ambit.

प्रतिक्रिया दिनुहोस्