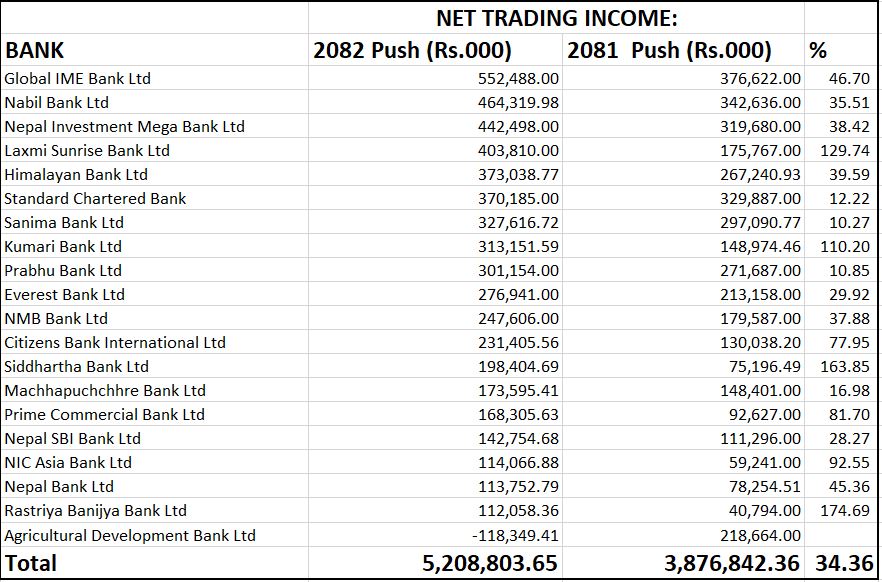

Kathmandu. In the first six months of the current fiscal year, commercial banks have earned a net trading income of Rs 5.20 billion.

This income has increased by 34.36 percent compared to the same period last year. In the same period of the last FY, the income of such banks was Rs 3.87 billion. Banks have taken advantage of the general improvement in the stock market and the rise in the value of the dollar.

The value of the dollar has been steadily increasing in recent years. As a result, the profit of banks from foreign currency transactions has increased. In the net trading income of banks, the income from share trading and foreign currency transactions is calculated.

Global IME Bank has the highest net trading income among the commercial banks in operation. The bank’s reward increased by 46.7 percent to Rs 55.24 crore. Likewise, Nabil Bank surged 35.51 per cent to Rs 464.319 crore, Nepal Investment Mega Bank by 38.42 per cent to Rs 442.49 crore and Laxmi Sanraj Bank by 129.7 per cent to Rs 403.81 million.

Similarly, the income of Himalayan Bank increased by 39.59 percent to Rs 373.38 crore, Standard Chartered Bank by 12.22 percent to Rs 370.85 crore, Sanima Bank by 10.27 percent to Rs 327.66 million and Kumari Bank by 110.2 percent to Rs 31.31 crore.

Similarly, Prabhu Bank grew by 10.85 per cent to Rs 301.54 crore, Everest Bank by 29.92 per cent to Rs 276.941 crore, NMB Bank by 37.88 per cent to Rs 247.66 million and Citizens Bank by 77.95 per cent to Rs 231.45 million.

Likewise, Siddhartha Bank surged by 163.8% to Rs 198.44 million, Machhapuchchhre Bank by 16.98 per cent to Rs 173.59 crore, Prime Bank by 81.7 per cent to Rs 168.35 million, Nepal SBI Bank by 28.27 per cent to Rs 142.75 crore, NIC Asia Bank by 92.55 per cent to Rs 114.40 million. Nepal Bank’s share of the total growth rate has increased by 45.36 percent to Rs 113.752 crore, while that of Rastriya Banijya Bank has increased by 174.7 percent to Rs 11.20 crore. Similarly, Agriculture Development Bank has a negative net worth of Rs 11.83 crore.

प्रतिक्रिया दिनुहोस्